Question: 11. If APT is correct then A. We can use CAPM model for evaluation of individual security's performance because it approximates the actual results quite

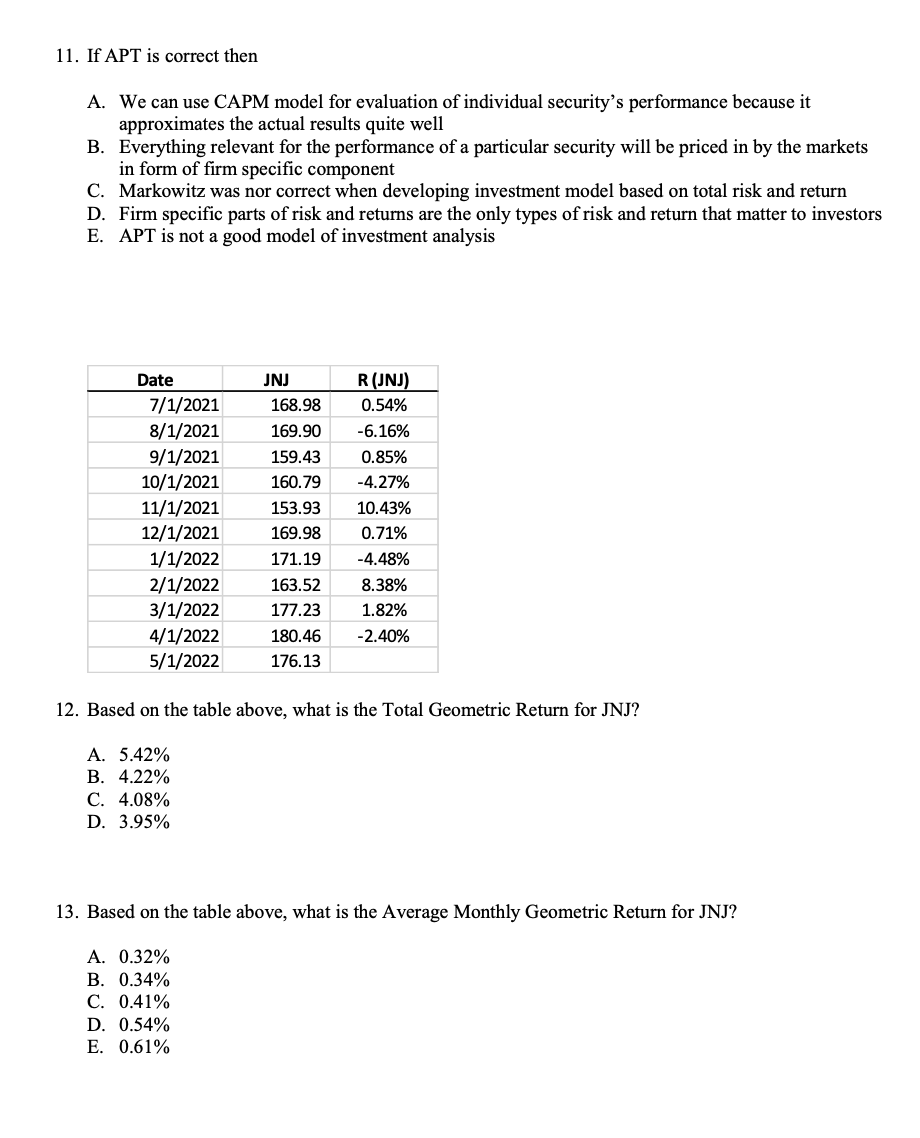

11. If APT is correct then A. We can use CAPM model for evaluation of individual security's performance because it approximates the actual results quite well B. Everything relevant for the performance of a particular security will be priced in by the markets in form of firm specific component C. Markowitz was nor correct when developing investment model based on total risk and return D. Firm specific parts of risk and returns are the only types of risk and return that matter to investors E. APT is not a good model of investment analysis Date 7/1/2021 8/1/2021 9/1/2021 10/1/2021 11/1/2021 12/1/2021 1/1/2022 2/1/2022 3/1/2022 4/1/2022 5/1/2022 JNJ 168.98 169.90 159.43 160.79 153.93 169.98 171.19 163.52 177.23 180.46 176.13 R (JNJ) 0.54% -6.16% 0.85% -4.27% 10.43% 0.71% -4.48% 8.38% 1.82% -2.40% 12. Based on the table above, what is the Total Geometric Return for JNJ? A. 5.42% B. 4.22% C. 4.08% D. 3.95% 13. Based on the table above, what is the Average Monthly Geometric Return for JNJ? A. 0.32% B. 0.34% C. 0.41% D. 0.54% E. 0.61% 11. If APT is correct then A. We can use CAPM model for evaluation of individual security's performance because it approximates the actual results quite well B. Everything relevant for the performance of a particular security will be priced in by the markets in form of firm specific component C. Markowitz was nor correct when developing investment model based on total risk and return D. Firm specific parts of risk and returns are the only types of risk and return that matter to investors E. APT is not a good model of investment analysis Date 7/1/2021 8/1/2021 9/1/2021 10/1/2021 11/1/2021 12/1/2021 1/1/2022 2/1/2022 3/1/2022 4/1/2022 5/1/2022 JNJ 168.98 169.90 159.43 160.79 153.93 169.98 171.19 163.52 177.23 180.46 176.13 R (JNJ) 0.54% -6.16% 0.85% -4.27% 10.43% 0.71% -4.48% 8.38% 1.82% -2.40% 12. Based on the table above, what is the Total Geometric Return for JNJ? A. 5.42% B. 4.22% C. 4.08% D. 3.95% 13. Based on the table above, what is the Average Monthly Geometric Return for JNJ? A. 0.32% B. 0.34% C. 0.41% D. 0.54% E. 0.61%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts