Question: 11. Ifthe amount lost per dollar on a defaulted loan is 40 percent, then a bank that does not permit the loss ofa loan to

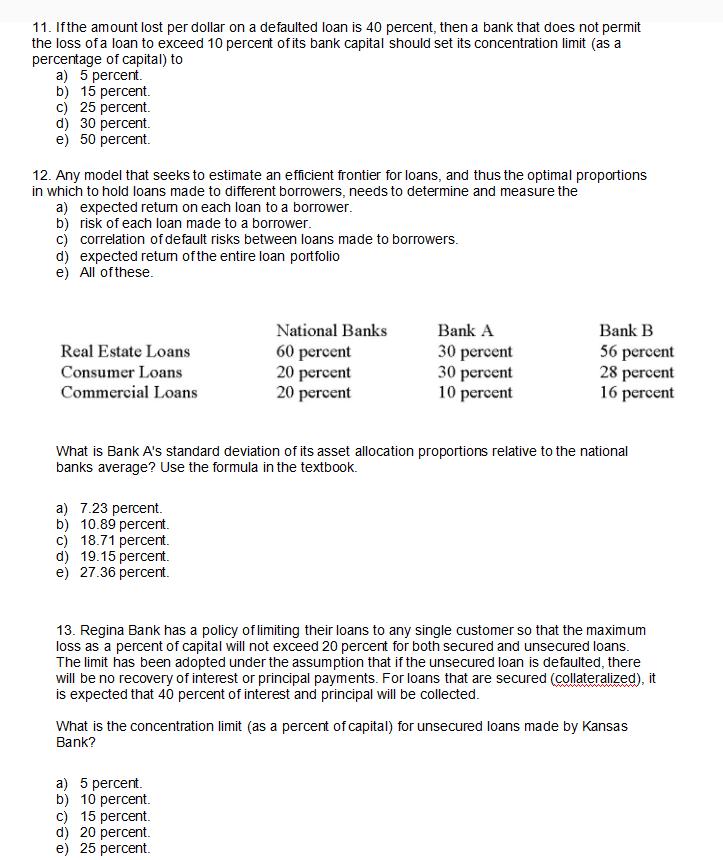

11. Ifthe amount lost per dollar on a defaulted loan is 40 percent, then a bank that does not permit the loss ofa loan to exceed 10 percent ofits bank capital should set its concentration limit (as a percentage of capital) to a) 5 percent b) 15 percent. c) 25 percent. d) 30 percent. e) 50 percent. 12. Any model that seeks to estimate an efficient frontier for loans, and thus the optimal proportions in which to hold loans made to different borrowers, needs to determine and measure the a) expected retum on each loan to a borrower. b) risk of each loan made to a borrower c) correlation of default risks between loans made to borrowers d) expected retum ofthe entire loan portfolio e) All ofthese Real Estate Loans Consumer Loans Commercial Loans National Banks 60 percent 20 percent 20 percent Bank A 30 percent 30 percent 10 percent Bank B 56 percent 28 percent 16 percent What is Bank A's standard deviation of its asset allocation proportions relative to the national banks average? Use the formula in the textbook. 7.23 percent. b) 10.89 percent. c) 18.71 percent. d) 19.15 percent. e) 27.36 percent. 13. Regina Bank has a policy oflimiting their loans to any single customer so that the maximum loss as a percent of capital will not exceed 20 percent for both secured and unsecured loans The limit has been adopted under the assumption that if the unsecured loan is defaulted, there will be no recovery of interest or principal payments. For loans that are secured (collateralized), it is expected that 40 percent of interest and principal will be collected What is the concentration limit (as a percent of capital) for unsecured loans made by Kansas Bank? a) 5 percent b) 10 percent. c) 15 percent. d) 20 percent. e) 25 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts