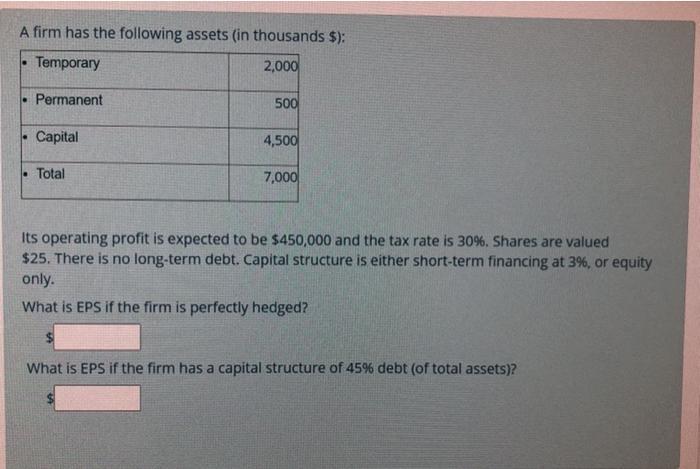

Question: firm has the following assets (in thousands $): Temporary 2,000 Permanent 500 Capital 4,500 Total 7,000 Its operating profit is expected to be $450,000

firm has the following assets (in thousands $): Temporary 2,000 Permanent 500 Capital 4,500 Total 7,000 Its operating profit is expected to be $450,000 and the tax rate is 30%. Shares are valued $25. There is no long-term debt. Capital structure is either short-term financing at 3%, or equity only. What is EPS if the firm is perfectly hedged? What is EPS if the firm has a capital structure of 45% debt (of total assets)?

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts