Question: 11. In the NPV calculation when you isolate one variable at a time to do robu4stness checks on your original base estimates, then this is

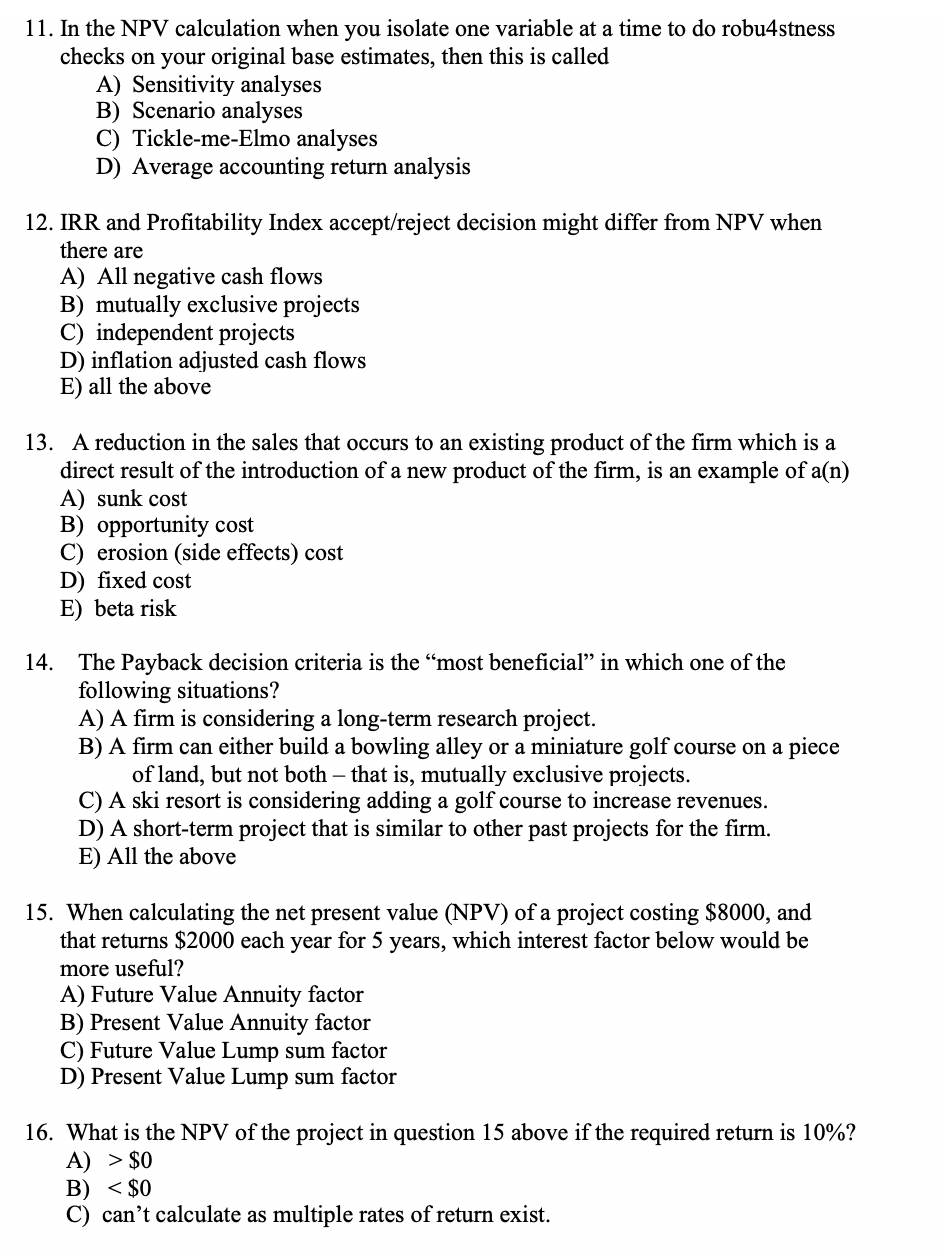

11. In the NPV calculation when you isolate one variable at a time to do robu4stness checks on your original base estimates, then this is called A) Sensitivity analyses B) Scenario analyses C) Tickle-me-Elmo analyses D) Average accounting return analysis 12. IRR and Profitability Index accept/reject decision might differ from NPV when there are A) All negative cash flows B) mutually exclusive projects C) independent projects D) inflation adjusted cash flows E) all the above 13. A reduction in the sales that occurs to an existing product of the firm which is a direct result of the introduction of a new product of the firm, is an example of a(n) A) sunk cost B) opportunity cost C) erosion (side effects) cost D) fixed cost E) beta risk 14. The Payback decision criteria is the most beneficial in which one of the following situations? A) A firm is considering a long-term research project. B) A firm can either build a bowling alley or a miniature golf course on a piece of land, but not both that is, mutually exclusive projects. C) A ski resort is considering adding a golf course to increase revenues. D) A short-term project that is similar to other past projects for the firm. E) All the above 15. When calculating the net present value (NPV) of a project costing $8000, and that returns $2000 each year for 5 years, which interest factor below would be more useful? A) Future Value Annuity factor B) Present Value Annuity factor C) Future Value Lump sum factor D) Present Value Lump sum factor 16. What is the NPV of the project in question 15 above if the required return is 10%? A) > $0 B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts