11. Korina Company manufactures products S and T from a joint process. The sales value at...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

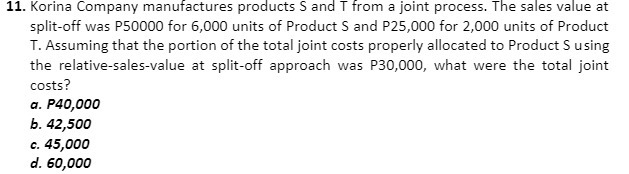

11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the portion of the total joint costs properly allocated to Product S using the relative-sales-value at split-off approach was P30,000, what were the total joint costs? a. P40,000 b. 42,500 c. 45,000 d. 60,000 11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the portion of the total joint costs properly allocated to Product S using the relative-sales-value at split-off approach was P30,000, what were the total joint costs? a. P40,000 b. 42,500 c. 45,000 d. 60,000

Expert Answer:

Posted Date:

Students also viewed these accounting questions

-

A researcher is interested in whether the variation in the size of human beings is proportional throughout each part of the human. To partly answer this question they looked at the correlation...

-

Volkswagen's Greenwashing Backfires: The Road to Redemption Describe the concept of greenwashing and explain how VW practiced greenwashing and state its implication on the company. Summarize VW's...

-

Karen Corp. manufactures products Y and Z from a joint process. The sales value at split-off was P50,000 for 6,000 units of Product Y and P25,000 for 2,000 units of Product Z. Question: Assuming that...

-

Some observers maintain that not all politicians move toward the middle of the political spectrum in order to obtain votes. They often cite Barry Goldwater in the 1964 presidential election and...

-

If there are n1 = 8 letters of one kind and n2 = 8 letters of another kind, for how many runs would we reject the null hypothesis of randomness at the 0.01 level of significance?

-

After World War II, several Nazis were convicted of "crimes against humanity" by an international court. Assuming that these convicted war criminals had not disobeyed any law of their country and had...

-

True or false? By reducing financial leverage, we reduce the cost of debt and the cost of equity, and accordingly, the weighted average cost of capital? Why?

-

Ensure the Sales worksheet is active . Enter a function in cell B8 to create a custom transaction number. The transaction number should be comprised of the item number listed in cell C8 combined with...

-

3. Show that if f and f constant. are both analytic on a domain D, then fis

-

Data for Jeter, Inc. and Gibson Corp. follow: (Click the icon to view the data.) Read the requirements. Data table Jeter Gibson Net Sales Revenue $ 11,000 $ 26,000 Cost of Goods Sold 6,721 19,084...

-

What factors allow developing nation firms and industries to "upgrade" within global value chains? Answer in reference to the Automobile industry. Made an argumentative answer and elaborate it with...

-

1) Differentiate the following function: y = 8e* + 5x 2) Determine f'(x) from f(x) = 4e5x

-

Bombardier and Embraer WTO issue How do international and national politics intersect with the corporate concerns of Bombardier and Embraer and What types of tensions between developed and developing...

-

Consider a population of snails in which individuals have either blue or yellow shells. Snail shell colour is heritable and determined by the colour of the shells of their parents. Yellow snails can...

-

What exactly does Krueger mean by "income mobility," and more precisely "intergenerational income mobility," and why is this notion so crucial to him in combating income inequality? What does this...

-

You need to choose service-based organisation based in the United Kingdom. A list of companies if provided as follows. You can pick any company from this list. Barclays Bank Deloitte KPMG DLA Piper...

-

Is that Yelp review real or fake? The article A Framework for Fake Review Detection in Online Consumer Electronics Retailers (Information Processing and Management 2019: 12341244) tested five...

-

What factors should be taken into account when designing a system of accounting for inflation?

-

Historical cost accounting is the worst possible accounting convention, until one considers the alternatives. Discuss this statement in relation to CPP, CCA and NRVA.

-

Discuss the effect on setting performance bonuses for staff if financial performance for a period contains both realised and unrealised gains/losses.

Study smarter with the SolutionInn App