Question: 11. Projected financial statements and basic analysis You are the most creative analyst for Saltwater Logistics Corp., and your admirers want to see you work

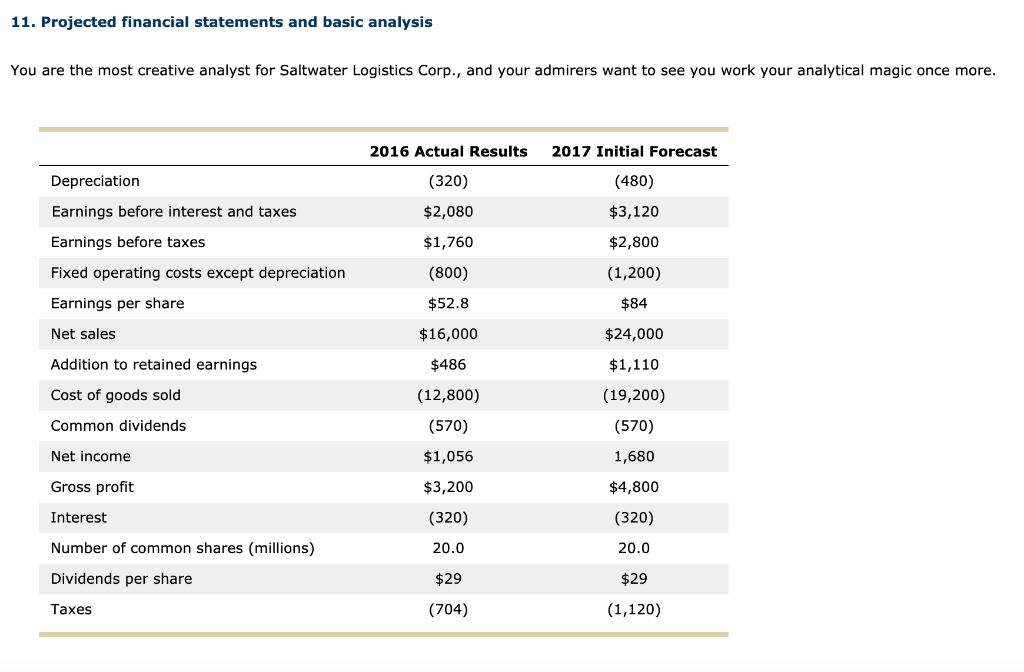

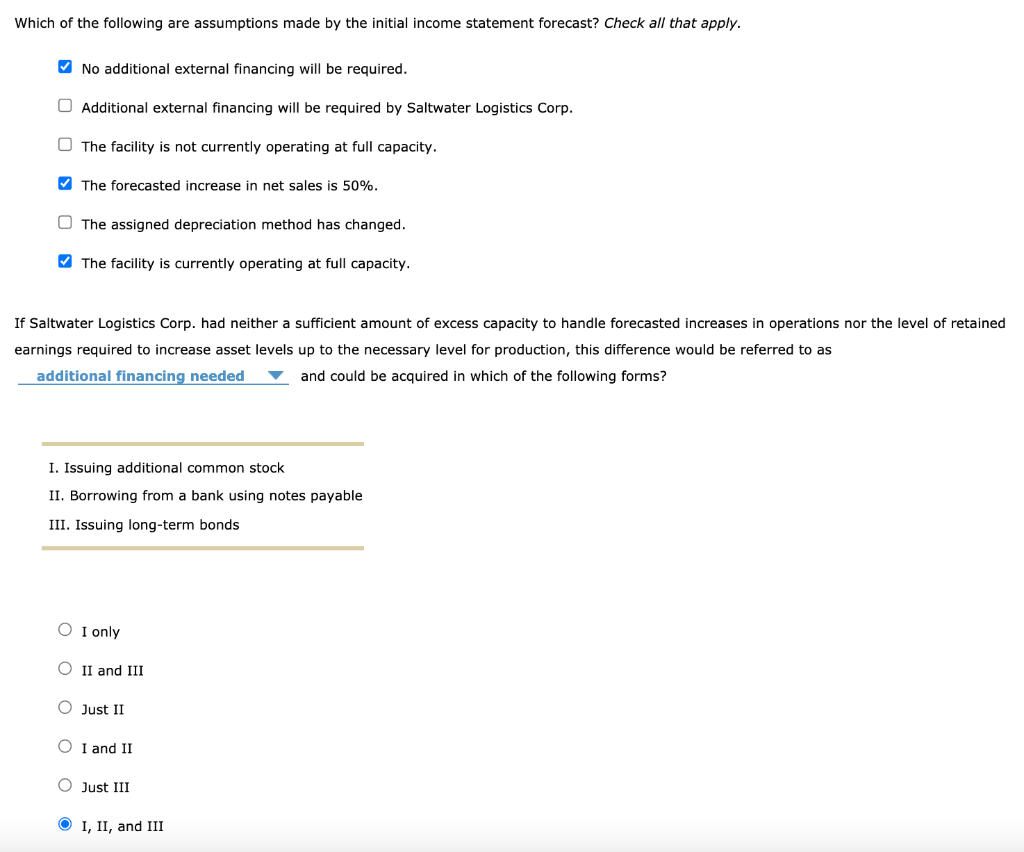

11. Projected financial statements and basic analysis You are the most creative analyst for Saltwater Logistics Corp., and your admirers want to see you work your analytical magic once more. 2016 Actual Results 2017 Initial Forecast (320) (480) Depreciation Earnings before interest and taxes $2,080 $3,120 Earnings before taxes $1,760 $2,800 (1,200) (800) Fixed operating costs except depreciation Earnings per share $52.8 $84 Net sales $16,000 $24,000 Addition to retained earnings $486 $1,110 Cost of goods sold (12,800) (570) (19,200) (570) Common dividends Net income $1,056 1,680 Gross profit $3,200 $4,800 Interest (320) (320) Number of common shares (millions) 20.0 20.0 Dividends per share $29 $29 Taxes (704) (1,120) Which of the following are assumptions made by the initial income statement forecast? Check all that apply. No additional external financing will be required. Additional external financing will be required by Saltwater Logistics Corp. The facility is not currently operating at full capacity. The forecasted increase in net sales is 50%. The assigned depreciation method has changed. The facility is currently operating at full capacity. If Saltwater Logistics Corp. had neither a sufficient amount of excess capacity to handle forecasted increases in operations nor the level of retained earnings required to increase asset levels up to the necessary level for production, this difference would be referred to as additional financing needed and could be acquired in which of the following forms? I. Issuing additional common stock II. Borrowing from a bank using notes payable III. Issuing long-term bonds O I only II and III O Just II O I and II O Just III I, II, and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts