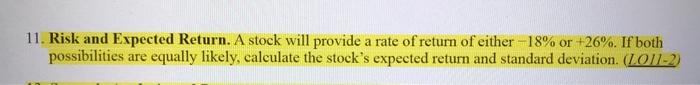

Question: 11. Risk and Expected Return. A stock will provide a rate of return of either 18% or +26%. If both possibilities are equally likely, calculate

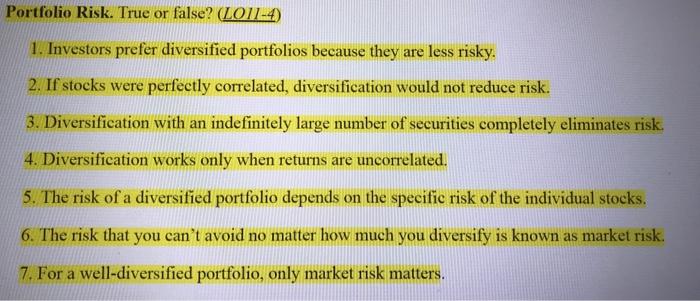

11. Risk and Expected Return. A stock will provide a rate of return of either 18% or +26%. If both possibilities are equally likely, calculate the stock's expected return and standard deviation. (IOOO/2) Portfolio Risk. True or false? (LO114) 1. Investors prefer diversified portfolios because they are less risky. 2. If stocks were perfectly correlated, diversification would not reduce risk. 3. Diversification with an indefinitely large number of securities completely eliminates risk. 4. Diversification works only when returns are uncorrelated. 5. The risk of a diversified portfolio depends on the specific risk of the individual stocks. 6. The risk that you can't avoid no matter how much you diversify is known as market risk. 7. For a well-diversified portfolio, only market risk matters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts