Question: Please answer with work demonstrated and the formulas. Thank you so much, I appreciate your time and help. Number 13 and number 14, please. Thank

Please answer with work demonstrated and the formulas. Thank you so much, I appreciate your time and help. Number 13 and number 14, please. Thank you.

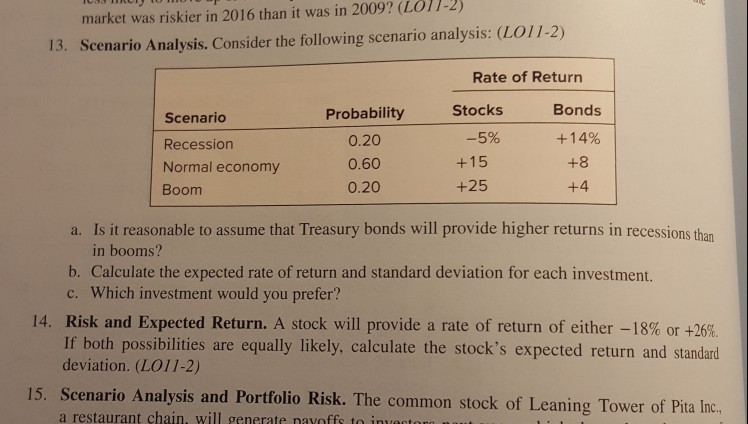

market was riskier in 2016 than it was in 2009? (LO1/-2) 13. Scenario Analysis. Consider the following scenario analysis: (LO11-2) Rate of Return Bonds +14% +8 +4 Stocks Scenario Recession Normal economy Boom Probability 0.20 0.60 0.20 -5% +15 +25 a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? 14. Risk and Expected Return. A stock will provide a rate of return of either-18% or +26%. If both possibilities are equally likely, calculate the stock's expected return and standard deviation. (LO11-2) 15. Scenario Analysis and Portfolio Risk. The common stock of Leaning Tower of Pita Inoc. a restaurant chain, will generate navofs to invest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts