Question: 11. True or false. Write true if the statement is correct, or false if the statement is incorrect. If true, explain why in at most

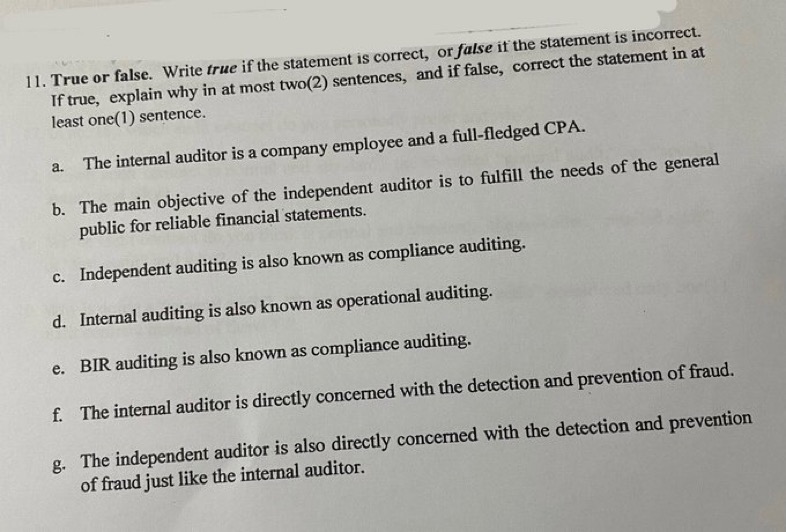

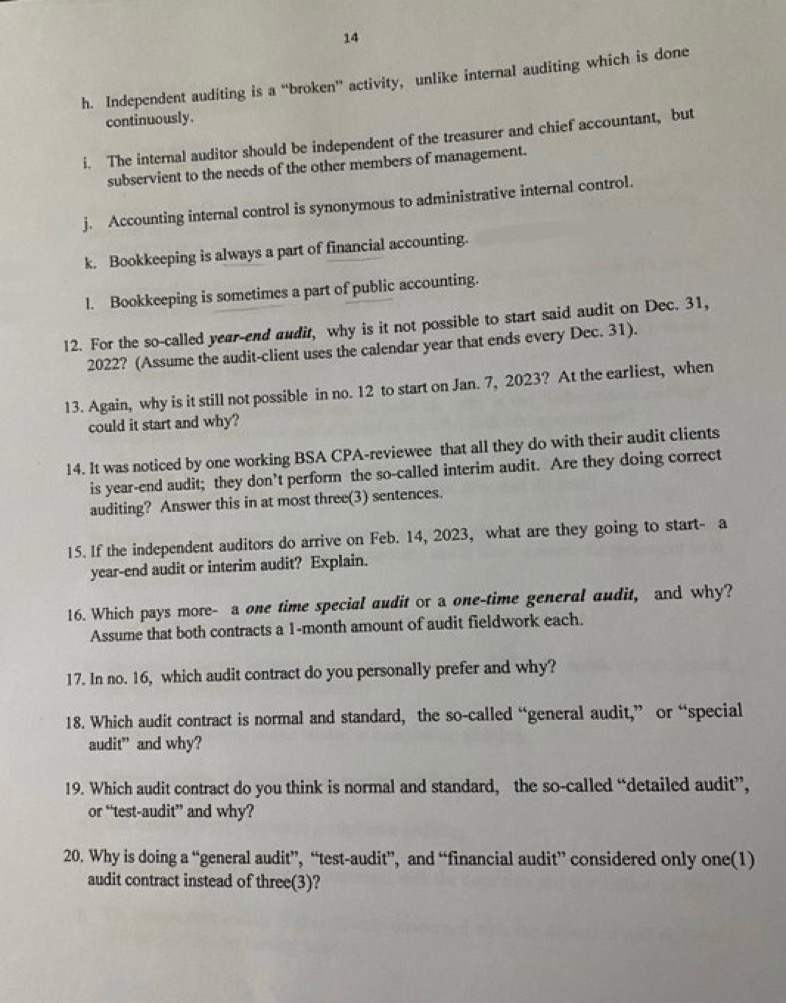

11. True or false. Write true if the statement is correct, or false if the statement is incorrect. If true, explain why in at most two(2) sentences, and if false, correct the statement in at least one(1) sentence. a. The internal auditor is a company employee and a full-fledged CPA. b. The main objective of the independent auditor is to fulfill the needs of the general public for reliable financial statements. c. Independent auditing is also known as compliance auditing. d. Internal auditing is also known as operational auditing. e. BIR auditing is also known as compliance auditing. f. The internal auditor is directly concerned with the detection and prevention of fraud. g. The independent auditor is also directly concerned with the detection and prevention of fraud just like the internal auditor.14 h. Independent auditing is a "broken" activity, unlike internal auditing which is done continuously. i. The internal auditor should be independent of the treasurer and chief accountant, but subservient to the needs of the other members of management. j. Accounting internal control is synonymous to administrative internal control. k. Bookkeeping is always a part of financial accounting. 1. Bookkeeping is sometimes a part of public accounting. 12. For the so-called year-end audit, why is it not possible to start said audit on Dec. 31, 2022? (Assume the audit-client uses the calendar year that ends every Dec. 31). 13. Again, why is it still not possible in no. 12 to start on Jan. 7, 2023? At the earliest, when could it start and why? 14. It was noticed by one working BSA CPA-reviewce that all they do with their audit clients is year-end audit; they don't perform the so-called interim audit. Are they doing correct auditing? Answer this in at most three(3) sentences. 15. If the independent auditors do arrive on Feb. 14, 2023, what are they going to start- a year-end audit or interim audit? Explain. 16. Which pays more- a one time special audit or a one-time general audit, and why? Assume that both contracts a 1-month amount of audit fieldwork each. 17, In no. 16, which audit contract do you personally prefer and why? 18. Which audit contract is normal and standard, the so-called "general audit," or "special audit" and why? 19. Which audit contract do you think is normal and standard, the so-called "detailed audit", or "test-audit" and why? 20. Why is doing a "general audit", "test-audit", and "financial audit" considered only one(1) audit contract instead of three(3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts