Question: 11.1- *PLEASE ANSWER ALL 5 QUESTIONS * 5 multiple choice questions: 1. 2. 3. 4. 5. Personal liability is a significant disadvantage of the partnership

11.1- *PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions:

1.

2.

3.

4.

5.

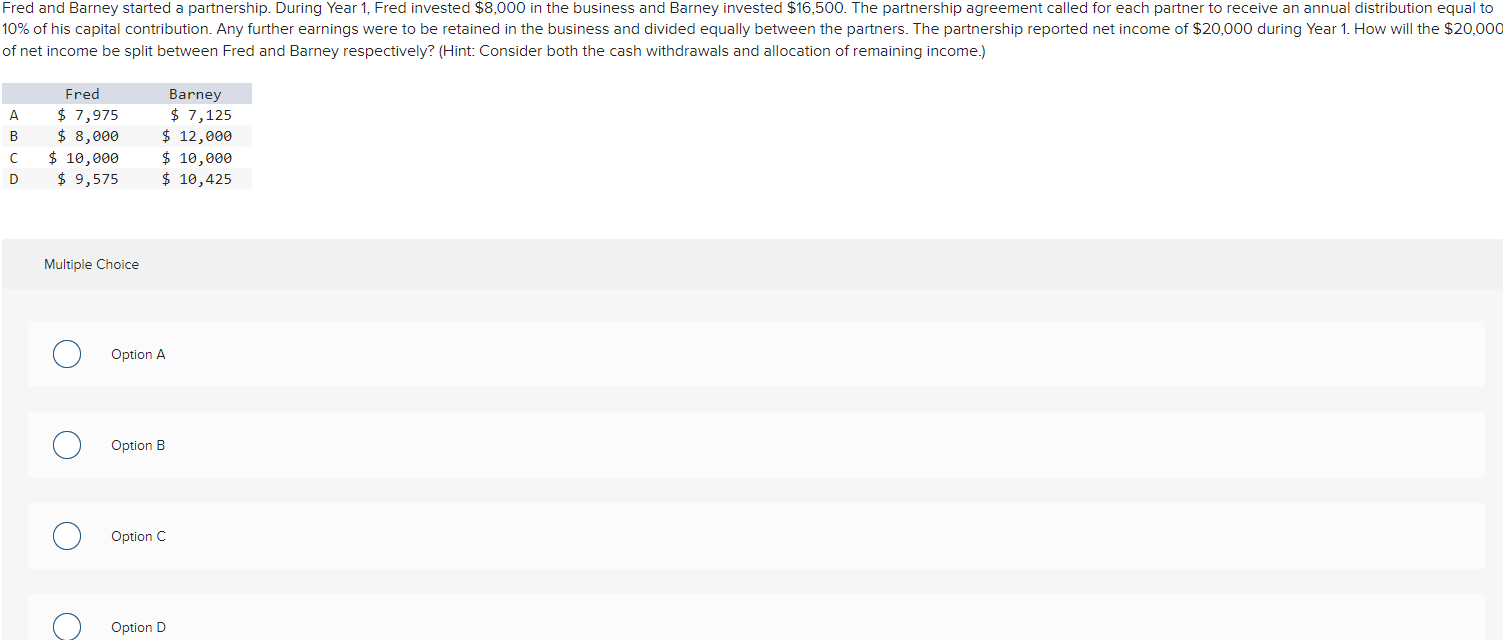

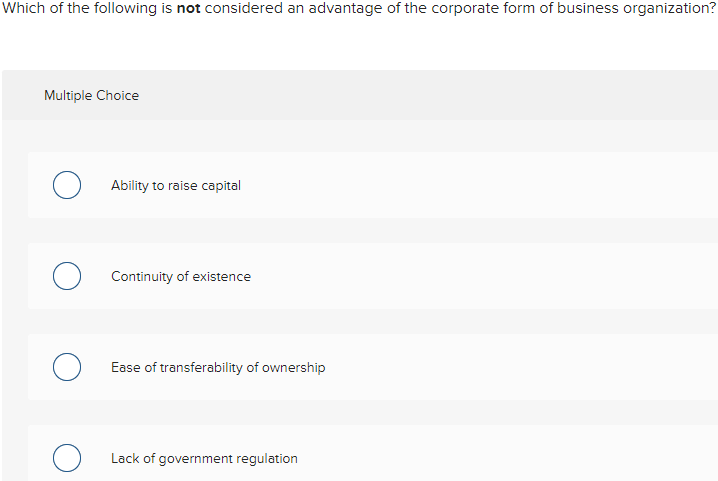

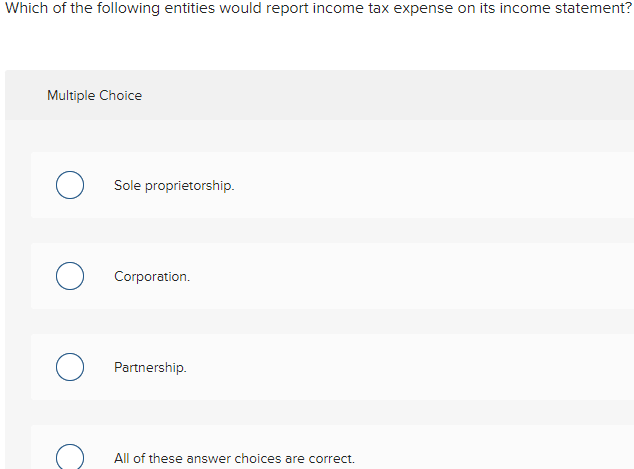

Personal liability is a significant disadvantage of the partnership form of business organization True or False A separate capital account is maintained for each partner in a partnership. True or False Ihich of the following entities would report income tax expense on its income statement? Multiple Choice Sole proprietorship. Corporation. Partnership. All of these answer choices are correct. f net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income.) Multiple Choice Option A Option B Option C Option D /hich of the following is not considered an advantage of the corporate form of business organization? Multiple Choice Ability to raise capital Continuity of existence Ease of transferability of ownership Lack of government regulation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts