Question: 11-23 Floatation cost. Please use Excel to show formula. 11-22 WACC Weights WhackAmOle has 2 million shares of common stock outstanding, 1.5 million shares of

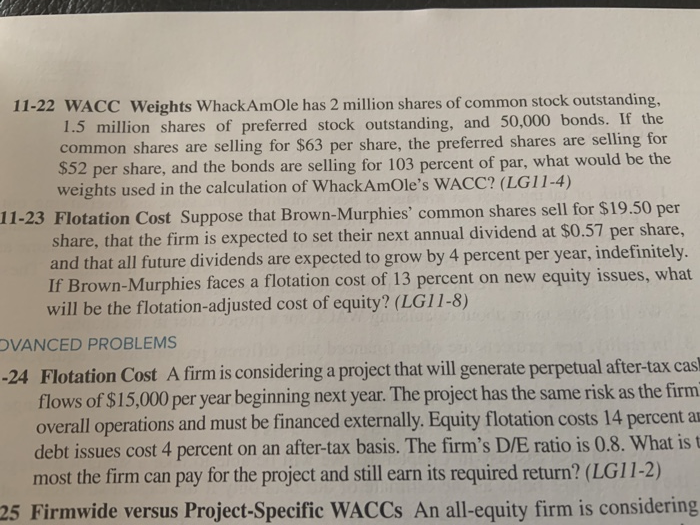

11-22 WACC Weights WhackAmOle has 2 million shares of common stock outstanding, 1.5 million shares of preferred stock outstanding, and 50,000 bonds. If the common shares are selling for $63 per share, the preferred shares are selling for $52 per share, and the bonds are selling for 103 percent of par, what would be the weights used in the calculation of WhackAmOle's WACC? (LG11-4) 11-23 Flotation Cost Suppose that Brown-Murphies' common shares sell for $19.50 per share, that the firm is expected to set their next annual dividend at $0.57 per share, and that all future dividends are expected to grow by 4 percent per year, indefinitely. If Brown-Murphies faces a flotation cost of 13 percent on new equity issues, what will be the flotation-adjusted cost of equity? (LGI1-8) VANCED PROBLEMS --24 Flotation Cost A firm is considering a project that will generate perpetual after-tax cas flows of $15,000 per year beginning next year. The project has the same risk as the firm overall operations and must be financed externally. Equity flotation costs 14 percent a debt issues cost 4 percent on an after-tax basis. The firm's D/E ratio is 0.8. What is most the firm can pay for the project and still earn its required return? (LG11-2) 25 Firmwide versus Project-Specific WACCs An all-equity firm is considering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts