Question: Please show all your work. First, state which formula to use & identify what each variable stands for. Identify variables from scenario and solve. Show

Please show all your work. First, state which formula to use & identify what each variable stands for. Identify variables from scenario and solve. Show all your steps.

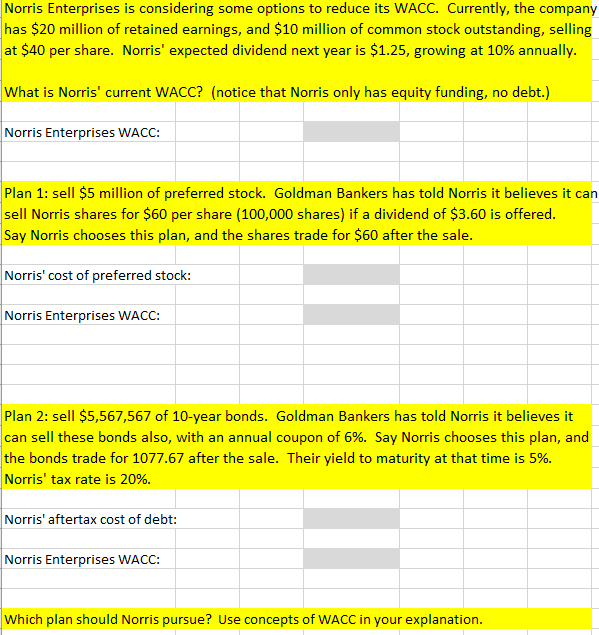

Norris Enterprises is considering some options to reduce its WACC. Currently, the company has $20 million of retained earnings, and $10 million of common stock outstanding, s at $40 per share. Norris' expected dividend next year is $1.25, growing at 10% annually What is Norris' current WACC? (notice that Norris only has equity funding, no debt.) Norris Enterprises WACC Plan 1: sell $5 million of preferred stock. Goldman Bankers has told Norris it believes it can sell Norris shares for $60 per share (100,000 shares) if a dividend of $3.60 is offered. Say Norris chooses this plan, and the shares trade for $60 after the sale Norris' cost of preferred stock: Norris Enterprises WACC: Plan 2: sell $5,567,567 of 10-year bonds. Goldman Bankers has told Norris it believes it can sell these bonds also, with an annual coupon of 6%. Say Norris chooses this plan, and the bonds trade for 1077.67 after the sale. Their yield to maturity at that time is 5%. Norris' tax rate is 20% Norris' aftertax cost of debt: Norris Enterprises WACC: Which plan should Norris pursue? Use concepts of WACC in your explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts