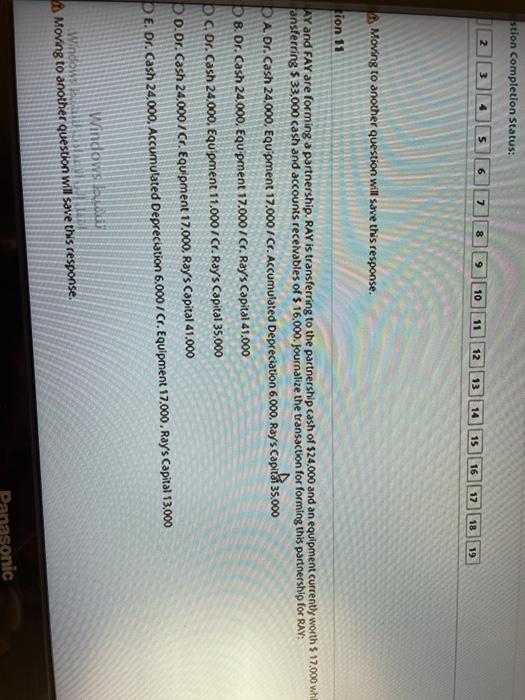

Question: (((11Please, I want a very fast solution. I need a solution in less than half an hour. Help me stion Completion Status: 2 3 5

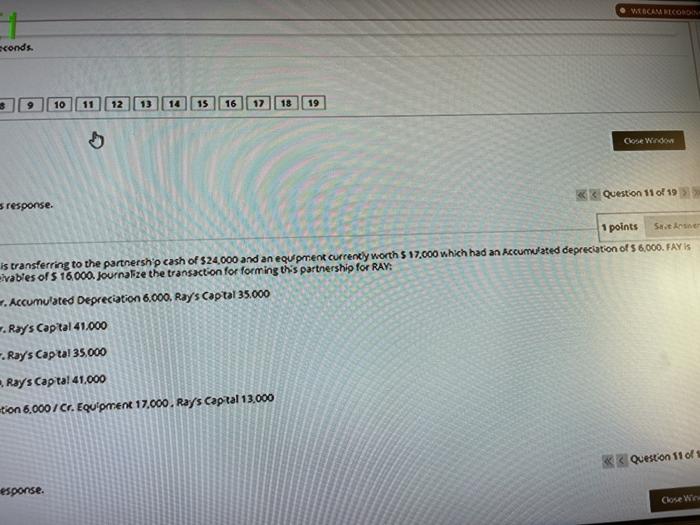

stion Completion Status: 2 3 5 6 7 00 9 10 11 12 13 14 15 16 17 18 19 Moving to another question will save this response. fion 11 AY and FAY are forming a partnership. RAY is transferring to the partnership cash of $24.000 and an equipment currently worth $ 17.000 whi ansferring 5 33,000 cash and accounts receivables of $ 16,000. Journalize the transaction for forming this partnership for RAY: ba Dr. Cash 24.000, Equipment 17.000/Cr. Accumulated Depreciation 6.000. Ray's capir 35.000 B. Dr. Cash 24.000. EQU pment 17.000 7 Cr. Ray's Capital 41.000 b c. Or. Cash 24.000, Equipment 11.000 1 Cr. Ray's Capital 35.000 DD.Dr. Cash 24.000 / Cr. Equipment 17.000. Ray's Capital 41,000 O E. Dr. Cash 24,000, Accumulated Depreciation 6,000 7 Cr. Equipment 17.000. Ray's Capital 13.000 Windows Windows Moving to another question will save this response. sonic WEBCAM PICOBON econds 9 10 11 12 13 14 15 16 17 18 19 Ce Widow Question 11 of 19 Sresponse. Swotne 1 points is transferring to the partnership cash of 24.000 and an equipment currently worth $ 17,000 which had an Accumulated depreciation of 5 6,000. FAY IS evables of $ 16,000. JournaFze the transaction for forming this partnership for RAY: -. Accumulated Depreciation 6,000. Ray's Captal 35.000 Ray's Capital 41.000 -Ray's Capital 35.000 Ray's Captal 41,000 tion 6.000 Cr. Equipment 17,000. Rays Capital 13,000 * Question 1103 esponse. Close

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts