Question: 12 1 , 7 100 Normal text Arial + BIYA 5 5.Karen Kay, a portfolio manager at Collins Asset Management, is using the CAPM to

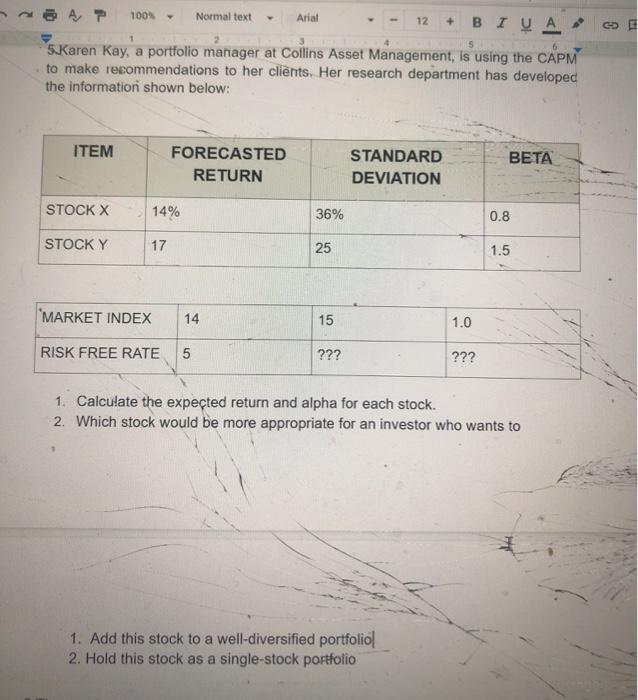

12 1 , 7 100 Normal text Arial + BIYA 5 5.Karen Kay, a portfolio manager at Collins Asset Management, is using the CAPM to make recommendations to her clients. Her research department has developed the information shown below: ITEM FORECASTED RETURN STANDARD DEVIATION BETA STOCK X 14% 36% 0.8 STOCK Y 17 25 1.5 MARKET INDEX 14 15 1.0 RISK FREE RATE 5 ??? ??? 1. Calculate the expected return and alpha for each stock. 2. Which stock would be more appropriate for an investor who wants to 1. Add this stock to a well-diversified portfoliol 2. Hold this stock as a single-stock portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts