Question: 12 13 14 15 16 Moving to another question will save this response. to 7016 estion 7 625 points Wergo Corp is considering two mutually

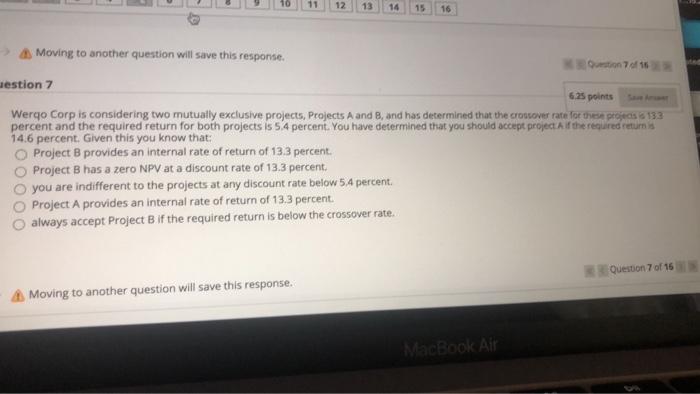

12 13 14 15 16 Moving to another question will save this response. to 7016 estion 7 625 points Wergo Corp is considering two mutually exclusive projects, Projects A and B, and has determined that the crossover rate for the projects 6 133 percent and the required return for both projects is 5:4 percent. You have determined that you should accept project if the required returns 14.6 percent. Given this you know that: Project B provides an internal rate of return of 13.3 percent. Project B has a zero NPV at a discount rate of 13.3 percent you are indifferent to the projects at any discount rate below 5.4 percent Project A provides an internal rate of return of 13.3 percent. always accept Project Bif the required return is below the crossover rate. Question 7 of 16 Moving to another question will save this response. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts