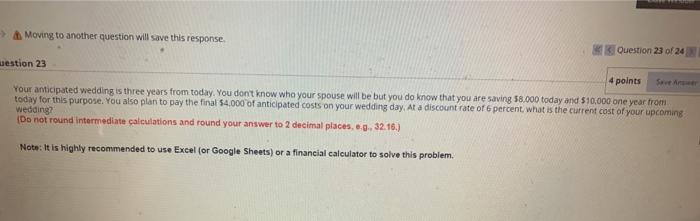

Question: > Moving to another question will save this response Question 23 of 24 uestion 23 4 points Save Anguer Your anticipated wedding is three years

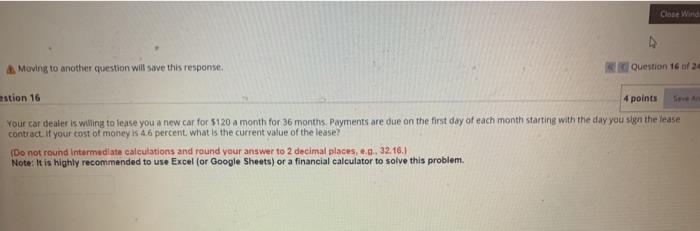

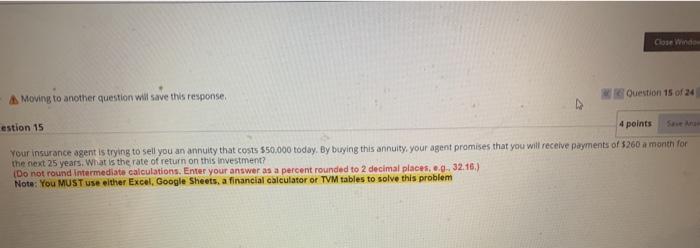

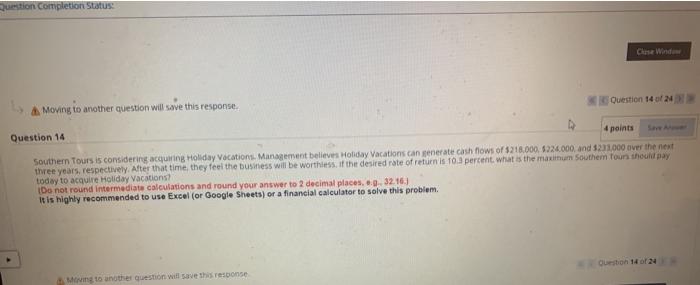

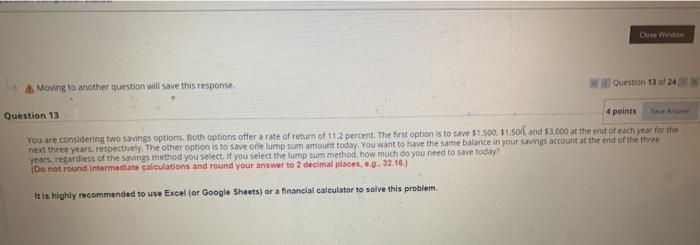

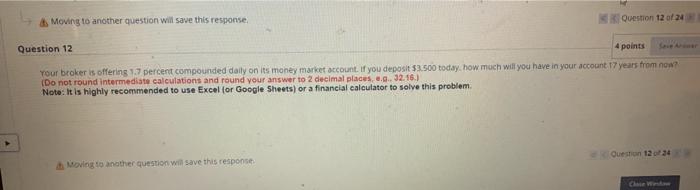

> Moving to another question will save this response Question 23 of 24 uestion 23 4 points Save Anguer Your anticipated wedding is three years from today. You don't know who your spouse will be but you do know that you are saving 58.000 today and $10,000 one year from today for this purpose. You also plan to pay the final $4.000 of anticipated costs on your wedding day. At a discount rate of 6 percent, what is the current cost of your upcoming wedding? (Do not found intermediate calculations and round your answer to 2 decimal places, 6.9. 32.16.) Note: It is highly recommended to use Excel (or Google Sheets) or a financial calculator to solve this problem. Close Wind Moving to another question will save this response, Question 16 of 2 stion 16 4 points Your car dealer is willing to lease you a new car for 5120 a month for 36 months. Payments are due on the first day of each month starting with the day you sign the lease contract. If your cost of money is 4.6 percent, what is the current value of the lease? (Do not round Intermediate calculations and round your answer to 2 decimal places, ... 32.16. Note: It is highly recommended to use Excel (or Google Sheets) or a financial calculator to solve this problem. Close Wwe A Moving to another question will save this response Ouestion 15 of 24 estion 15 4 points Your insurance agent is trying to sell you an annuity that costs $50,000 today. By buying this annuity, your agent promises that you will receive payments of $260 a month for the next 25 years. What is the rate of return on this investment? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, 9. 32. 10.) Note: You MUST use either Excel, Google Sheets, a financial Calculator or TVM tables to solve this problem Question completion Status: Close Wind Question 14 of 24 A Moving to another question will save this response. Question 14 4 points Southern Tours is considering acquiring Holiday Vacations Management believes Holiday Vacations can generate cash flows of $218.000 $220.000, and 1231.000 over the next three years, respectively. After that time they feel the business will be worthless, if the desired rate of return is 10.3 percent. what is the main southem four should pay today to acquire Holiday Vacations! Do not round intermediate calculations and round your answer to 2 decimal places....3216.) it is highly recommended to use Excel (or Google Sheets) or a financial calculator to solve this problem. Question 14 of 24 Mmg to another question will save this response Che Wir Moving to another question will save this response. Question 11 of 24 Question 13 4 points You are considering two savings options. Both options offer a rate of return of 11.2 percent. The first option is to save $1.500.$1.500 and $3.000 at the end of each year for the next three years. respectively. The other option is to save one lump sum amount today. You want to have the same balance in your savings account at the end of the three years. regardless of the saving method you select if you select the lump sum method, how much do you need to save today? Do not round intermediate calculations and round your answer to 2 decimal places, 0.3216) It is highly recommended to use Excel for Google Sheets) or a financial calculator to solve this problem Moving to another question will save this response Question 12 of 24 Question 12 4 points Your broker is offering 1.7 percent compounded daily on its money market account. If you deposit $3.500 today, how much will you have in your account 17 years from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e... 32.16.) Note: It is highly recommended to use Excel for Google Sheets) or a financial calculator to solve this problem Question 1234 Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts