Question: 12 16 8 b) Based on the trading and performance data for three different equity funds (Datox, Makln and Sandy) shown below, select which fund

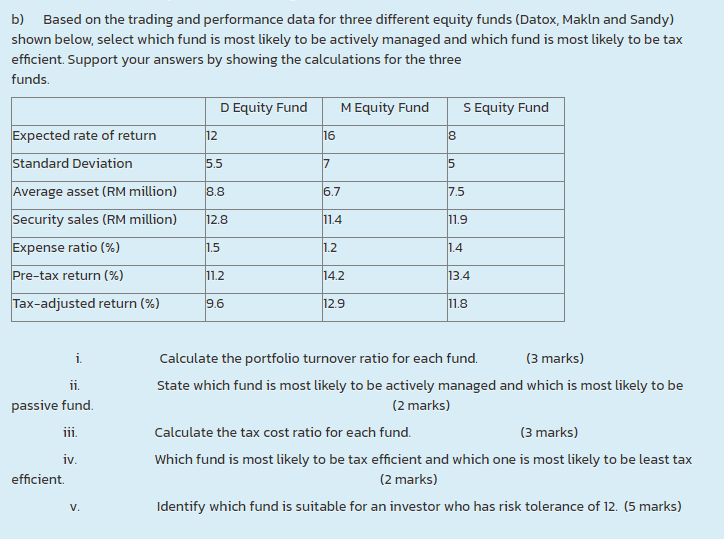

12 16 8 b) Based on the trading and performance data for three different equity funds (Datox, Makln and Sandy) shown below, select which fund is most likely to be actively managed and which fund is most likely to be tax efficient. Support your answers by showing the calculations for the three funds. D Equity Fund M Equity Fund S Equity Fund Expected rate of return Standard Deviation Average asset (RM million) Security sales (RM million) Expense ratio (%) 1.2 Pre-tax return (%) 13.4 Tax-adjusted return (%) 9.6 11.8 5.5 7 5 8.8 6.7 7.5 12.8 11.4 11.9 1.5 1.4 11.2 14.2 12.9 i ii. passive fund iii. Calculate the portfolio turnover ratio for each fund. (3 marks) State which fund is most likely to be actively managed and which is most likely to be (2 marks) Calculate the tax cost ratio for each fund. (3 marks) Which fund is most likely to be tax efficient and which one is most likely to be least tax (2 marks) Identify which fund is suitable for an investor who has risk tolerance of 12. (5 marks) iv. efficient. V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts