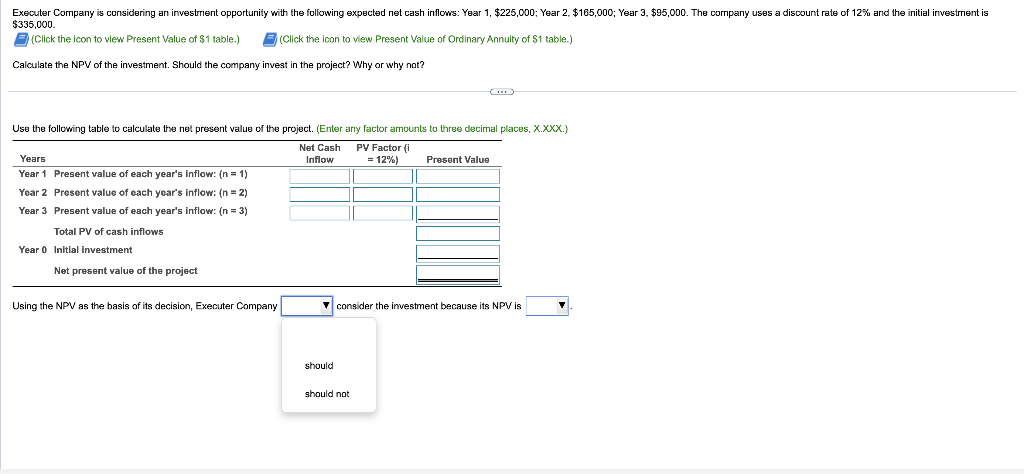

Question: #12 3335,000 . (Cllck the icon to view Present Value of $1 table.) 'Click the icon to view Present Value of Ordinary Annulty of $1

#12

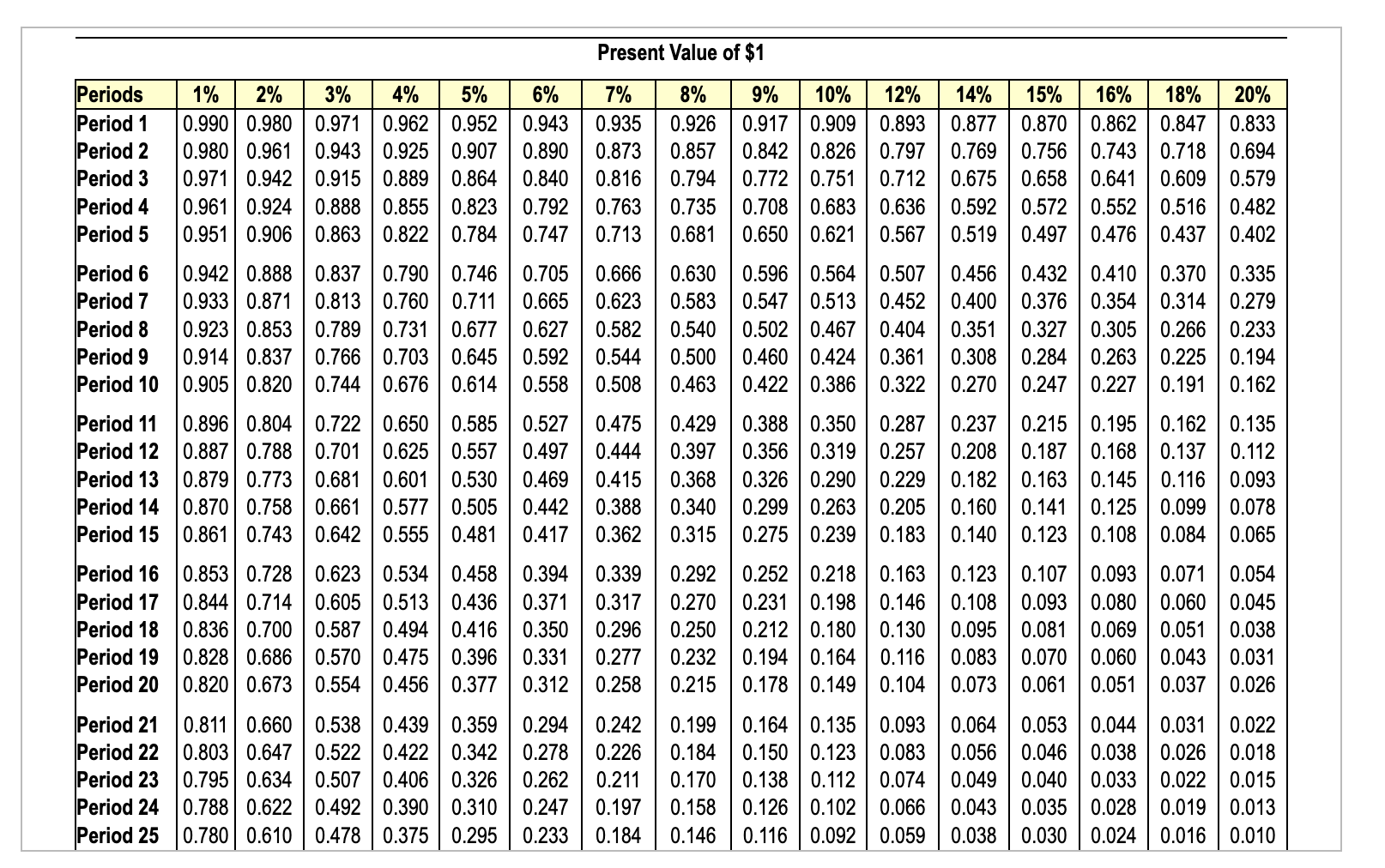

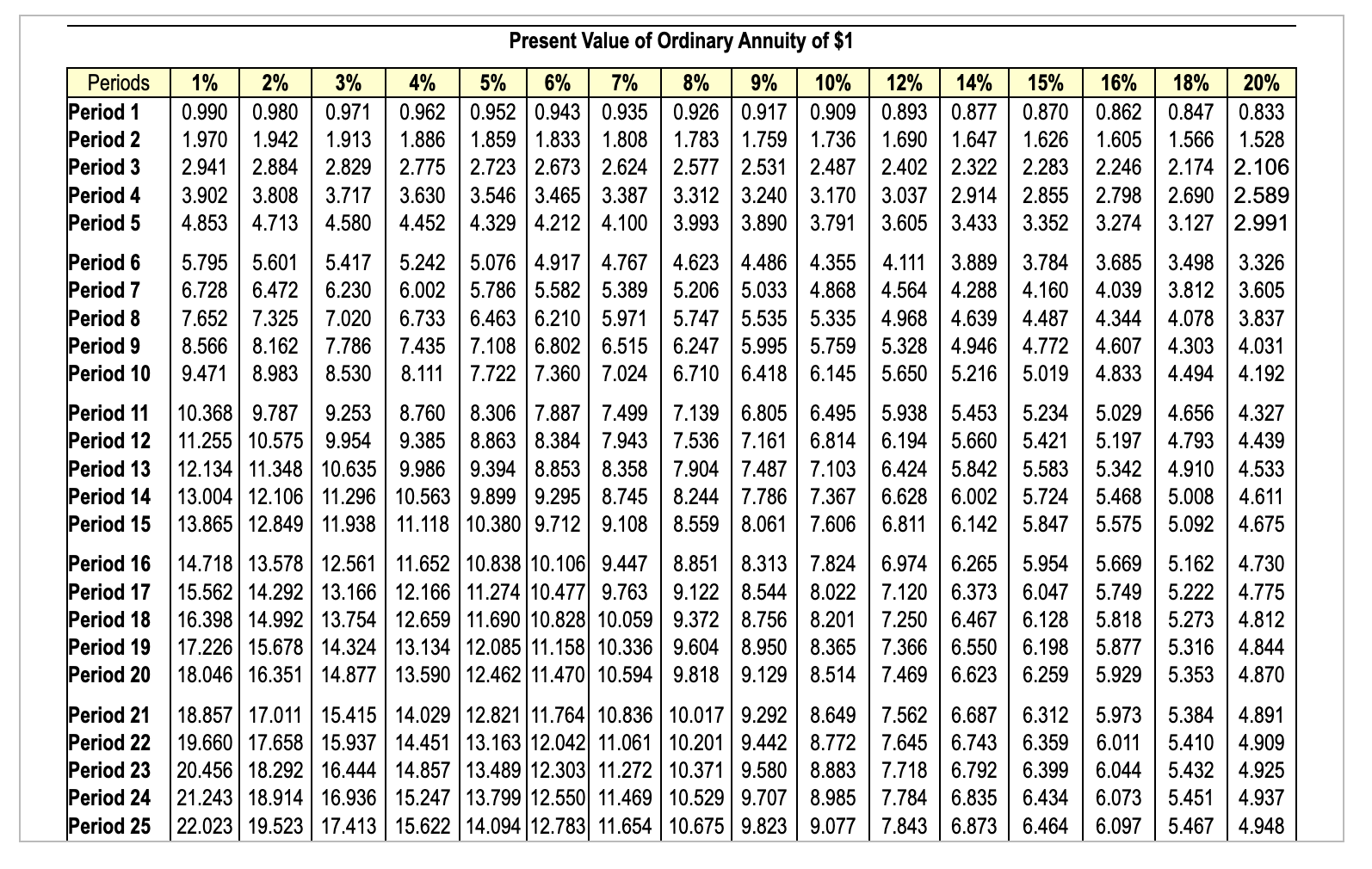

3335,000 . (Cllck the icon to view Present Value of \$1 table.) 'Click the icon to view Present Value of Ordinary Annulty of $1 table.) Calculate the NPV of the investment. Should the company invest in the project? Why or why not? Use the following table to calculate the net present value of the project. (Enter arly factor amounts to three decimal places, X.XXX.) Using the NPV as the basis of its decision, Executer Company consider the imvestment because its NPV is \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{} \\ \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% & 16% & 18% & 20% \\ \hline Period 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.870 & 0.862 & 0.847 & 0.833 & \\ Period 2 & 0.980 & 0.961 & 0.943 & 0.925 & 0.907 & 0.890 & 0.873 & 0.857 & 0.842 & 0.826 & 0.797 & 0.769 & 0.756 & 0.743 & 0.718 & 0.694 & \\ Period 3 & 0.971 & 0.942 & 0.915 & 0.889 & 0.864 & 0.840 & 0.816 & 0.794 & 0.772 & 0.751 & 0.712 & 0.675 & 0.658 & 0.641 & 0.609 & 0.579 & \\ Period 4 & 0.961 & 0.924 & 0.888 & 0.855 & 0.823 & 0.792 & 0.763 & 0.735 & 0.708 & 0.683 & 0.636 & 0.592 & 0.572 & 0.552 & 0.516 & 0.482 & \\ Period 5 & 0.951 & 0.906 & 0.863 & 0.822 & 0.784 & 0.747 & 0.713 & 0.681 & 0.650 & 0.621 & 0.567 & 0.519 & 0.497 & 0.476 & 0.437 & 0.402 & \\ Period 6 & 0.942 & 0.888 & 0.837 & 0.790 & 0.746 & 0.705 & 0.666 & 0.630 & 0.596 & 0.564 & 0.507 & 0.456 & 0.432 & 0.410 & 0.370 & 0.335 & \\ Period 7 & 0.933 & 0.871 & 0.813 & 0.760 & 0.711 & 0.665 & 0.623 & 0.583 & 0.547 & 0.513 & 0.452 & 0.400 & 0.376 & 0.354 & 0.314 & 0.279 & \\ Period 8 & 0.923 & 0.853 & 0.789 & 0.731 & 0.677 & 0.627 & 0.582 & 0.540 & 0.502 & 0.467 & 0.404 & 0.351 & 0.327 & 0.305 & 0.266 & 0.233 & \\ Period 9 & 0.914 & 0.837 & 0.766 & 0.703 & 0.645 & 0.592 & 0.544 & 0.500 & 0.460 & 0.424 & 0.361 & 0.308 & 0.284 & 0.263 & 0.225 & 0.194 & \\ Period 10 & 0.905 & 0.820 & 0.744 & 0.676 & 0.614 & 0.558 & 0.508 & 0.463 & 0.422 & 0.386 & 0.322 & 0.270 & 0.247 & 0.227 & 0.191 & 0.162 & \\ Period 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.475 & 0.429 & 0.388 & 0.350 & 0.287 & 0.237 & 0.215 & 0.195 & 0.162 & 0.135 & \\ Period 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.444 & 0.397 & 0.356 & 0.319 & 0.257 & 0.208 & 0.187 & 0.168 & 0.137 & 0.112 & \\ Period 13 & 0.879 & 0. \end{tabular} Present Value of Ordinary Annuity of $1 \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% & 16% & 18% & 20% \\ \hline Period 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.870 & 0.862 & 0.847 & 0.833 \\ Period 2 & 1.970 & 1.942 & 1.913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 & 1.736 & 1.690 & 1.647 & 1.626 & 1.605 & 1.566 & 1.528 & \\ Period 3 & 2.941 & 2.884 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.577 & 2.531 & 2.487 & 2.402 & 2.322 & 2.283 & 2.246 & 2.174 & 2.106 & \\ Period 4 & 3.902 & 3.808 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3.240 & 3.170 & 3.037 & 2.914 & 2.855 & 2.798 & 2.690 & 2.589 & \\ Period 5 & 4.853 & 4.713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.605 & 3.433 & 3.352 & 3.274 & 3.127 & 2.991 & \\ Period 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4.917 & 4.767 & 4.623 & 4.486 & 4.355 & 4.111 & 3.889 & 3.784 & 3.685 & 3.498 & 3.326 & \\ Period 7 & 6.728 & 6.472 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 & 4.868 & 4.564 & 4.288 & 4.160 & 4.039 & 3.812 & 3.605 & \\ Period 8 & 7.652 & 7.325 & 7.020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 & 5.335 & 4.968 & 4.639 & 4.487 & 4.344 & 4.078 & 3.837 & \\ Period 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.995 & 5.759 & 5.328 & 4.946 & 4.772 & 4.607 & 4.303 & 4.031 & \\ Period 10 & 9.471 & 8.983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.650 & 5.216 & 5.019 & 4.833 & 4.494 & 4.192 & \\ Period 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7.499 & 7.139 & 6.805 & 6.495 & 5.938 & 5.453 & 5.234 & 5.029 & 4.656 & 4.327 & \\ Period 12 & 11.255 & 10.575 & 9.954 & 9.385 & 8.863 & 8.384 & 7.943 & 7.536 & 7.161 & 6.814 & 6.194 & 5.660 & 5.421 & 5.197 & 4.793 & 4.439 & \\ Period 13 & 12.134 & 11.348 & 10.635 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts