Question: 12. An OMR 100 bond with two years to maturity and an annual coupon of 9 per cent is available. (The next coupon is payable

12. An OMR 100 bond with two years to maturity and an annual coupon of 9 per cent is available. (The next coupon is payable in one year.) a. If the market requires a yield to maturity of 9 per cent for a bond of this risk class what will be its market price? b. If the required yield to maturity on this type of bond changes to 10 per cent, what will the market price change to?

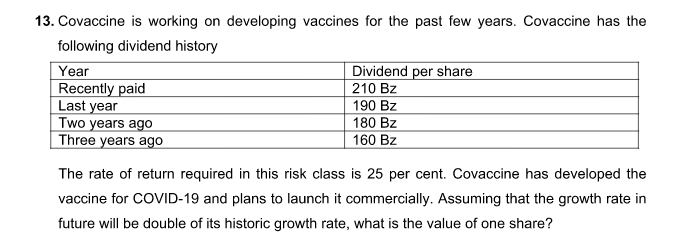

13. Covaccine is working on developing vaccines for the past few years. Covaccine has the following dividend history Year Dividend per share Recently paid 210 BZ Last year 190 BZ Two years ago 180 Bz Three years ago 160 BZ The rate of return required in this risk class is 25 per cent. Covaccine has developed the vaccine for COVID-19 and plans to launch it commercially. Assuming that the growth rate in future will be double of its historic growth rate, what is the value of one share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts