Question: 12. An OMR 100 bond with two years to maturity and an annual coupon of 9 per cent is available. (The next coupon is payable

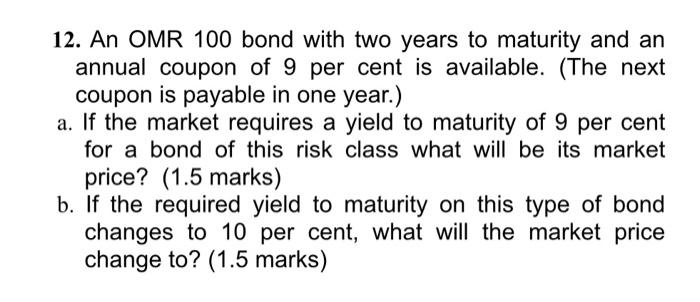

12. An OMR 100 bond with two years to maturity and an annual coupon of 9 per cent is available. (The next coupon is payable in one year.) a. If the market requires a yield to maturity of 9 per cent for a bond of this risk class what will be its market price? (1.5 marks) b. If the required yield to maturity on this type of bond changes to 10 per cent, what will the market price change to? (1.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts