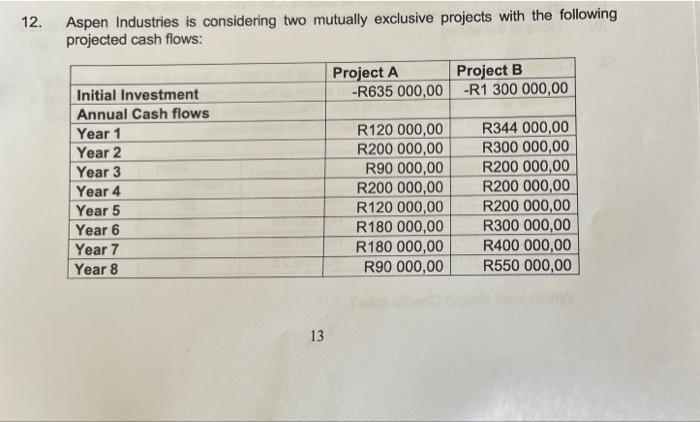

Question: 12. Aspen Industries is considering two mutually exclusive projects with the following projected cash flows: Project A Project B -R635 000,00 -R1 300 000,00 Initial

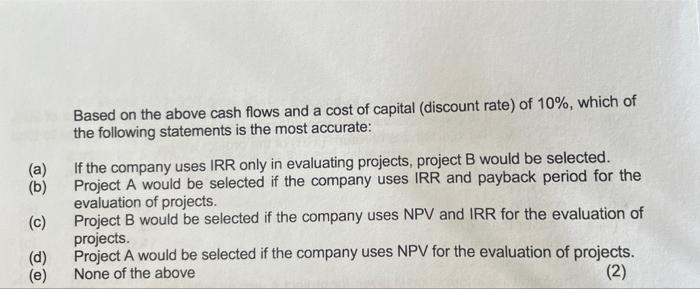

12. Aspen Industries is considering two mutually exclusive projects with the following projected cash flows: Project A Project B -R635 000,00 -R1 300 000,00 Initial Investment Annual Cash flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 R120 000,00 R200 000,00 R90 000,00 R200 000,00 R120 000,00 R180 000,00 R180 000,00 R90 000,00 R344 000,00 R300 000,00 R200 000,00 R200 000,00 R200 000,00 R300 000,00 R400 000,00 R550 000,00 13 (a) (b) Based on the above cash flows and a cost of capital (discount rate) of 10%, which of the following statements is the most accurate: If the company uses IRR only in evaluating projects, project B would be selected. Project A would be selected if the company uses IRR and payback period for the evaluation of projects. Project B would be selected if the company uses NPV and IRR for the evaluation of projects. Project A would be selected if the company uses NPV for the evaluation of projects. None of the above (2) (c) (d) (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts