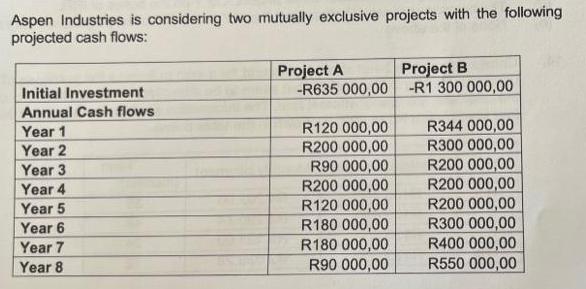

Question: Aspen Industries is considering two mutually exclusive projects with the following projected cash flows: Initial Investment Annual Cash flows Year 1 Year 2 Year

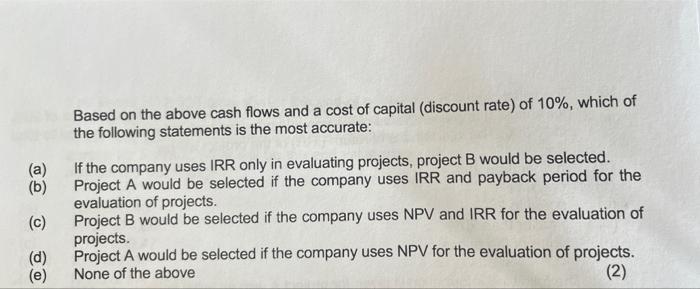

Aspen Industries is considering two mutually exclusive projects with the following projected cash flows: Initial Investment Annual Cash flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Project A -R635 000,00 R120 000,00 R200 000,00 R90 000,00 R200 000,00 R120 000,00 R180 000,00 R180 000,00 R90 000,00 Project B -R1 300 000,00 R344 000,00 R300 000,00 R200 000,00 R200 000,00 R200 000,00 R300 000,00 R400 000,00 R550 000,00 (a) (b) If the company uses IRR only in evaluating projects, project B would be selected. Project A would be selected if the company uses IRR and payback period for the evaluation of projects. Project B would be selected if the company uses NPV and IRR for the evaluation of projects. (d) Project A would be selected if the company uses NPV for the evaluation of projects. (e) None of the above (2) Based on the above cash flows and a cost of capital (discount rate) of 10%, which of the following statements is the most accurate: (c)

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Solution Part 1 Calculation of NPV of both the projec... View full answer

Get step-by-step solutions from verified subject matter experts