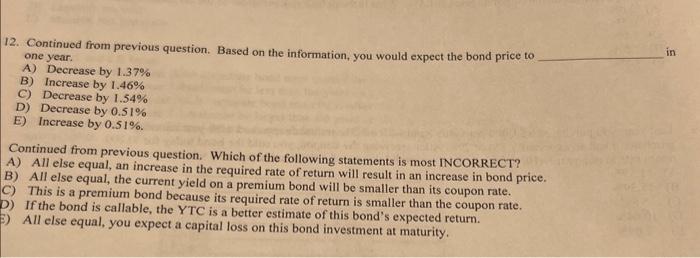

Question: 12. Continued from previous question. Based on the information, you would expect the bond price to in one year. A) Decrease by 1.37% B) Increase

12. Continued from previous question. Based on the information, you would expect the bond price to in one year. A) Decrease by 1.37% B) Increase by 1.46\% C) Decrease by 1.54% D) Decrease by 0.51% E) Increase by 0.51%. Continued from previous question. Which of the following statements is most INCORRECT? A) All else equal, an increase in the required rate of return will result in an increase in bond price. B) All else equal, the current yield on a premium bond will be smaller than its coupon rate. C) This is a premium bond because its required rate of return is smaller than the coupon rate. If the bond is callable, the YTC is a better estimate of this bond's expected return. All else equal, you expect a capital loss on this bond investment at maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts