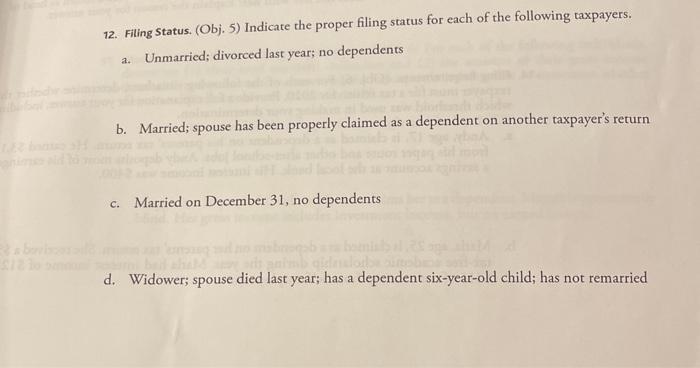

Question: 12. Filing Status. (Obj. 5) Indicate the proper filing status for each of the following taxpayers. Unmarried; divorced last year; no dependents a. b. Married;

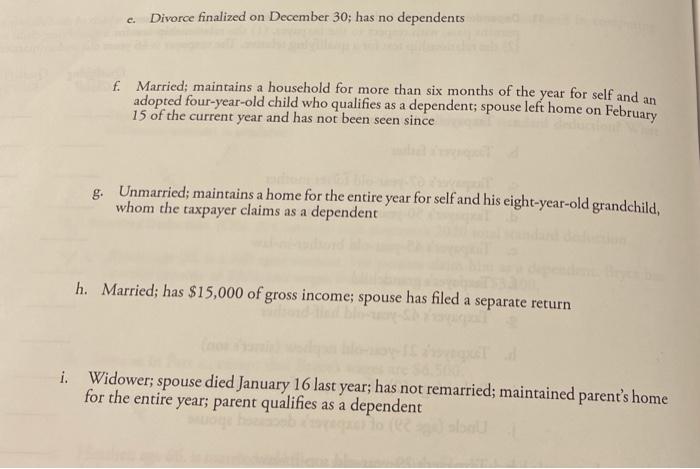

12. Filing Status. (Obj. 5) Indicate the proper filing status for each of the following taxpayers. Unmarried; divorced last year; no dependents a. b. Married; spouse has been properly claimed as a dependent on another taxpayer's return C. Married on December 31, no dependents d. Widower; spouse died last year; has a dependent six-year-old child; has not remarried Divorce finalized on December 30; has no dependents f. Married; maintains a household for more than six months of the year for self and an adopted four-year-old child who qualifies as a dependent; spouse left home on February 15 of the current year and has not been seen since g. Unmarried; maintains a home for the entire year for self and his eight-year-old grandchild, whom the taxpayer claims as a dependent h. Married; has $15,000 of gross income; spouse has filed a separate return i. Widower; spouse died January 16 last year; has not remarried, maintained parent's home for the entire year; parent qualifies as a dependent Com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts