Question: 12) Gina's Apartment Ventures (c.p. problem 7.10) is analyzing a venture opportunity. Land will be purchased for $1M at the end of this year (2020).

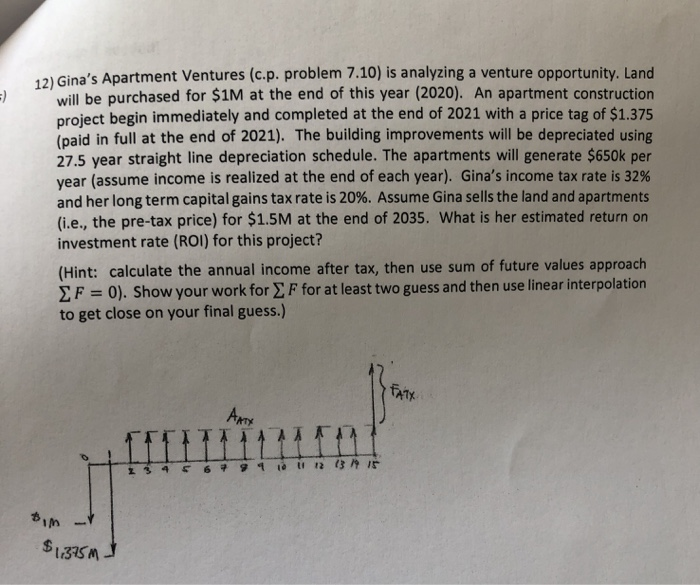

12) Gina's Apartment Ventures (c.p. problem 7.10) is analyzing a venture opportunity. Land will be purchased for $1M at the end of this year (2020). An apartment construction project begin immediately and completed at the end of 2021 with a price tag of $1.375 (paid in full at the end of 2021). The building improvements will be depreciated using 27.5 year straight line depreciation schedule. The apartments will generate $650k per year (assume income is realized at the end of each year). Gina's income tax rate is 32% and her long term capital gains tax rate is 20%. Assume Gina sells the land and apartments (i.e., the pre-tax price) for $1.5M at the end of 2035. What is her estimated return on investment rate (ROI) for this project? (Hint: calculate the annual income after tax, then use sum of future values approach F = 0). Show your work for F for at least two guess and then use linear interpolation to get close on your final guess.) 11 13 ir 2 3 4 tim $1,375m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts