Question: 12 In this section you should read the case and ask yourself, What's happening here right now? What are the issues that the firm faces

12

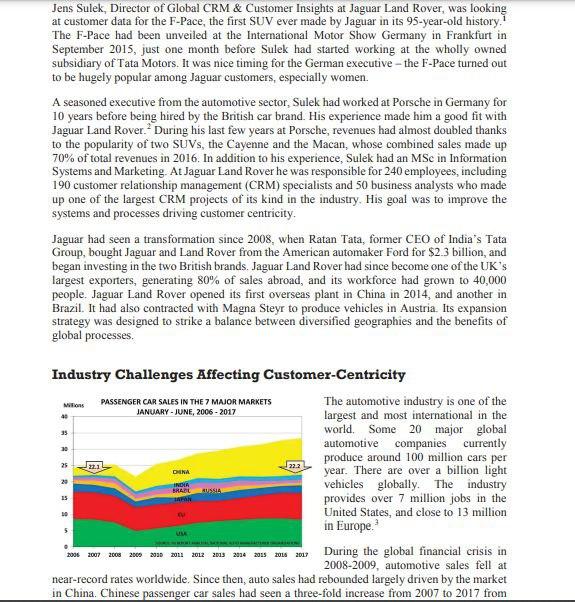

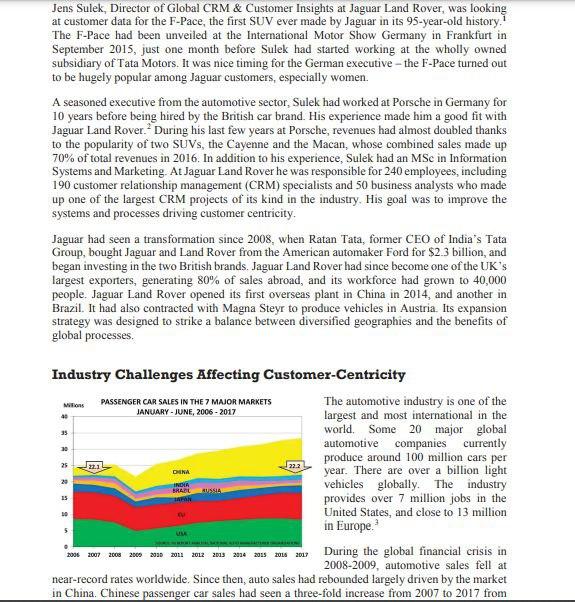

In this section you should read the case and ask yourself, "What's happening here right now? What are the issues that the firm faces within the context of the case? In many cases there are issues that involve more than one business function. For example, are there marketing issues, management issues, organizational issues, competitive issues, financial issues, etc.? Your executive summary should briefly identify the key issue(s) at hand and describe how you will come up with your solution. Briefly, but specifically, mention your key strategies at the end of this section. This section should be one page maximum-preferably half a page. It might help to write this as your last section. For Parts II and beyond, remember: You are not writing a "report." You are writing an analysis. You should take the information in the case, think about it, and then report your thoughts. You should be comfortable saying "think..."and be comfortable making bold statements. Think of yourself as a consultant hired by the firm to give them strategic advice. They already know what it's in the case-they want your take on the situation. The use of outside information may be appropriate to support your claims, thoughts and ideas. Part II. Identify Internal Strengths What is the firm doing well internally? Why is it doing these things well? And, more importantly, how do the strengths of the firm tie to marketing theory and concepts? What lead to the success of the firm in the past for present)? What strengths of the firm will lead to future value? Part III. Identify Internal Weaknesses What is the firm doing poorly internally? Why is it doing these things poorly? What lead to these poor tactics? How do the weaknesses contradict "good" marketing theory and concepts? Part IV. Identify External Opportunities What is going on the firm's external environment that the firm can use to its advantage? For example, if you are analyzing a case on McDonald's, an external opportunity might be the fact that the Atkins Diet has run its course and people are eating carbs again. These are not strategies here-those will come later (Part VII). In this section, focus on the external variables the firm can take advantage of. Part V. Identify External Threats What is going on in the firm's external environment that the firm needs to defend against Analyze competitors-competition is certainly one external threat. Maybe government regulation is another. Possibly the taste of the target market is another. For example, if you are analyzing a case on Amtrak one major threat is the growth of Southwest airlines and cheap, national air travel. Part VI. Other Issues / Metrics What other issues are going on in the case? How does the firm's financial situation look? If financial data is given, what are the trends you see? Does anything you see "jump out" at you? Is there a lot of debt? Any expenses seem odd? Are there any other issues out there that didn't quite fit in Parts II-V? Discuss them here. Part VII. Strategies Based on all the issues that you identified in Parts II-VI. what do you recommend that the firm do now? Be specific as possible. General strategies like "sell more products" are a gimme and add little to your analysis. You have to think deep here. How can the firm use its strengths to take advantage of external issues? How might the firm have to defend itself against threats? How can the firm shore up weaknesses? Again, think of yourself as someone hired to help this firm. What do you tell them and why? What are the risks and short/long term implications of what you suggest? (Please note that this should be your longest section. Jens Sulek, Director of Global CRM & Customer Insights at Jaguar Land Rover, was looking at customer data for the F-Pace, the first SUV ever made by Jaguar in its 95-year-old history. The F-Pace had been unveiled at the International Motor Show Germany in Frankfurt in September 2015, just one month before Sulek had started working at the wholly owned subsidiary of Tata Motors. It was nice timing for the German executive - the F-Pace turned out to be hugely popular among Jaguar customers, especially women. A seasoned executive from the automotive sector, Sulek had worked at Porsche in Germany for 10 years before being hired by the British car brand. His experience made him a good fit with Jaguar Land Rover. During his last few years at Porsche, revenues had almost doubled thanks to the popularity of two SUVs, the Cayenne and the Macan, whose combined sales made up 70% of total revenues in 2016. In addition to his experience, Sulek had an MSc in Information Systems and Marketing. At Jaguar Land Rover he was responsible for 240 employees, including 190 customer relationship management (CRM) specialists and 50 business analysts who made up one of the largest CRM projects of its kind in the industry. His goal was to improve the systems and processes driving customer centricity Jaguar had seen a transformation since 2008, when Ratan Tata, former CEO of India's Tata Group, bought Jaguar and Land Rover from the American automaker Ford for $2.3 billion, and began investing in the two British brands. Jaguar Land Rover had since become one of the UK's largest exporters, generating 80% of sales abroad, and its workforce had grown to 40,000 people. Jaguar Land Rover opened its first overseas plant in China in 2014, and another in Brazil. It had also contracted with Magna Steyr to produce vehicles in Austria. Its expansion strategy was designed to strike a balance between diversified geographies and the benefits of global processes. Misions 48 PASSENGER CAR SALES IN THE 7 MAJOR MARKETS JANUARY - JUNE, 2006 - 2017 35 30 25 ON 22.2 Industry Challenges Affecting Customer-Centricity The automotive industry is one of the largest and most international in the world. Some 20 major global automotive companies currently produce around 100 million cars per year. There are over a billion light vehicles globally. The industry provides over 7 million jobs in the United States, and close to 13 million in Europe. 2010 2011 2012 2013 2014 2015 2016 2017 During the global financial crisis in 2008-2009, automotive sales fell at near-record rates worldwide. Since then, auto sales had rebounded largely driven by the market in China. Chinese passenger car sales had seen a three-fold increase from 2007 to 2017 from INDIA BRADE AN 15 2006 2007 2008 2000 3.1 million to 11.3 million Sales in the other top six markets had only recovered to 2007 levels a decade later (see chart). But what if the Chinese market suddenly cooled? Indeed, this appeared to be happening Passenger car sales in China rose by just 2.7% in the first half of 2017, compared with an 11% increase in the first half of 2016. Furthermore, price discounts represented up to 4% in the first half 2017. Meanwhile, the used car market had become more attractive as the quality of vehicles "made in China" improved. The average life of a Chinese-made car rose from three years in 2012 to 4.5 years in 2017. These figures were a cause for concern among western automakers (like Jaguar Land Rover) which had made China a focus of their growth plans. Sales of traditional cars had also been affected by government policies, as in Norway, where buyers were incentivized to purchase hybrids and electric vehicles (EVS). As a result, Norway was the world leader in sales of energy-saving vehicles: 35% of new cars sold were either hybrids or EVs, and a target date of zero emissions from new cars was set at 2025. Local government was also pushing to bring air quality under control in cities like Paris and Beijing. In the UK and France, there was a ban on new petrol and diesel car sales from 2040. China, India and Norway were considering similar bans that could take effect earlier. Indirectly, the CAFE (Corporate Average Fuel Economy) standards made it more expensive for carmakers to build gas-guzzling cars by introducing penalties. Seven of the world's 11 largest carmakers were on course to miss CO targets by 2021. VW potentially faced a 1.7 billion fine for exceeding the co- limit on its cars. According to PA Consulting, only Volvo, Toyota, the Renault-Nissan Alliance and Jaguar Land Rover were on track to meet requirements, and even they might miss the target if there was a shift to petrol cars, which emitted more CO-than diesel. While the global market for pure EVs was still tiny - accounting for less than 1% of sales in 2016 - it had grown so quickly that Volvo Cars was the first to announce plans to switch to EV production. Owned by Chinese carmaker Geely since 2010, Volvo said it would stop producing vehicles powered solely by an internal combustion engine in 2019 and equip every model with an electric motor. Others followed suit. Jaguar Land Rover announced that all new models would come with the electrified option from 2020. Tesla, which produced only EVs, had launched its Model 3 with a base price of $35,000, designed for the mass market. With so much hype about hybrids and EVs, many car owners were concerned about the future value of their traditional combustion-engine vehicles. Like a computer on wheels, an EV is simpler and cheaper to produce than an internal combustion engine vehicle because it has far fewer parts. Employees of traditional carmakers were concerned too, as it was estimated that the demise of combustion engine cars could result in the loss of millions of jobs. In this section you should read the case and ask yourself, "What's happening here right now? What are the issues that the firm faces within the context of the case? In many cases there are issues that involve more than one business function. For example, are there marketing issues, management issues, organizational issues, competitive issues, financial issues, etc.? Your executive summary should briefly identify the key issue(s) at hand and describe how you will come up with your solution. Briefly, but specifically, mention your key strategies at the end of this section. This section should be one page maximum-preferably half a page. It might help to write this as your last section. For Parts II and beyond, remember: You are not writing a "report." You are writing an analysis. You should take the information in the case, think about it, and then report your thoughts. You should be comfortable saying "think..."and be comfortable making bold statements. Think of yourself as a consultant hired by the firm to give them strategic advice. They already know what it's in the case-they want your take on the situation. The use of outside information may be appropriate to support your claims, thoughts and ideas. Part II. Identify Internal Strengths What is the firm doing well internally? Why is it doing these things well? And, more importantly, how do the strengths of the firm tie to marketing theory and concepts? What lead to the success of the firm in the past for present)? What strengths of the firm will lead to future value? Part III. Identify Internal Weaknesses What is the firm doing poorly internally? Why is it doing these things poorly? What lead to these poor tactics? How do the weaknesses contradict "good" marketing theory and concepts? Part IV. Identify External Opportunities What is going on the firm's external environment that the firm can use to its advantage? For example, if you are analyzing a case on McDonald's, an external opportunity might be the fact that the Atkins Diet has run its course and people are eating carbs again. These are not strategies here-those will come later (Part VII). In this section, focus on the external variables the firm can take advantage of. Part V. Identify External Threats What is going on in the firm's external environment that the firm needs to defend against Analyze competitors-competition is certainly one external threat. Maybe government regulation is another. Possibly the taste of the target market is another. For example, if you are analyzing a case on Amtrak one major threat is the growth of Southwest airlines and cheap, national air travel. Part VI. Other Issues / Metrics What other issues are going on in the case? How does the firm's financial situation look? If financial data is given, what are the trends you see? Does anything you see "jump out" at you? Is there a lot of debt? Any expenses seem odd? Are there any other issues out there that didn't quite fit in Parts II-V? Discuss them here. Part VII. Strategies Based on all the issues that you identified in Parts II-VI. what do you recommend that the firm do now? Be specific as possible. General strategies like "sell more products" are a gimme and add little to your analysis. You have to think deep here. How can the firm use its strengths to take advantage of external issues? How might the firm have to defend itself against threats? How can the firm shore up weaknesses? Again, think of yourself as someone hired to help this firm. What do you tell them and why? What are the risks and short/long term implications of what you suggest? (Please note that this should be your longest section. Jens Sulek, Director of Global CRM & Customer Insights at Jaguar Land Rover, was looking at customer data for the F-Pace, the first SUV ever made by Jaguar in its 95-year-old history. The F-Pace had been unveiled at the International Motor Show Germany in Frankfurt in September 2015, just one month before Sulek had started working at the wholly owned subsidiary of Tata Motors. It was nice timing for the German executive - the F-Pace turned out to be hugely popular among Jaguar customers, especially women. A seasoned executive from the automotive sector, Sulek had worked at Porsche in Germany for 10 years before being hired by the British car brand. His experience made him a good fit with Jaguar Land Rover. During his last few years at Porsche, revenues had almost doubled thanks to the popularity of two SUVs, the Cayenne and the Macan, whose combined sales made up 70% of total revenues in 2016. In addition to his experience, Sulek had an MSc in Information Systems and Marketing. At Jaguar Land Rover he was responsible for 240 employees, including 190 customer relationship management (CRM) specialists and 50 business analysts who made up one of the largest CRM projects of its kind in the industry. His goal was to improve the systems and processes driving customer centricity Jaguar had seen a transformation since 2008, when Ratan Tata, former CEO of India's Tata Group, bought Jaguar and Land Rover from the American automaker Ford for $2.3 billion, and began investing in the two British brands. Jaguar Land Rover had since become one of the UK's largest exporters, generating 80% of sales abroad, and its workforce had grown to 40,000 people. Jaguar Land Rover opened its first overseas plant in China in 2014, and another in Brazil. It had also contracted with Magna Steyr to produce vehicles in Austria. Its expansion strategy was designed to strike a balance between diversified geographies and the benefits of global processes. Misions 48 PASSENGER CAR SALES IN THE 7 MAJOR MARKETS JANUARY - JUNE, 2006 - 2017 35 30 25 ON 22.2 Industry Challenges Affecting Customer-Centricity The automotive industry is one of the largest and most international in the world. Some 20 major global automotive companies currently produce around 100 million cars per year. There are over a billion light vehicles globally. The industry provides over 7 million jobs in the United States, and close to 13 million in Europe. 2010 2011 2012 2013 2014 2015 2016 2017 During the global financial crisis in 2008-2009, automotive sales fell at near-record rates worldwide. Since then, auto sales had rebounded largely driven by the market in China. Chinese passenger car sales had seen a three-fold increase from 2007 to 2017 from INDIA BRADE AN 15 2006 2007 2008 2000 3.1 million to 11.3 million Sales in the other top six markets had only recovered to 2007 levels a decade later (see chart). But what if the Chinese market suddenly cooled? Indeed, this appeared to be happening Passenger car sales in China rose by just 2.7% in the first half of 2017, compared with an 11% increase in the first half of 2016. Furthermore, price discounts represented up to 4% in the first half 2017. Meanwhile, the used car market had become more attractive as the quality of vehicles "made in China" improved. The average life of a Chinese-made car rose from three years in 2012 to 4.5 years in 2017. These figures were a cause for concern among western automakers (like Jaguar Land Rover) which had made China a focus of their growth plans. Sales of traditional cars had also been affected by government policies, as in Norway, where buyers were incentivized to purchase hybrids and electric vehicles (EVS). As a result, Norway was the world leader in sales of energy-saving vehicles: 35% of new cars sold were either hybrids or EVs, and a target date of zero emissions from new cars was set at 2025. Local government was also pushing to bring air quality under control in cities like Paris and Beijing. In the UK and France, there was a ban on new petrol and diesel car sales from 2040. China, India and Norway were considering similar bans that could take effect earlier. Indirectly, the CAFE (Corporate Average Fuel Economy) standards made it more expensive for carmakers to build gas-guzzling cars by introducing penalties. Seven of the world's 11 largest carmakers were on course to miss CO targets by 2021. VW potentially faced a 1.7 billion fine for exceeding the co- limit on its cars. According to PA Consulting, only Volvo, Toyota, the Renault-Nissan Alliance and Jaguar Land Rover were on track to meet requirements, and even they might miss the target if there was a shift to petrol cars, which emitted more CO-than diesel. While the global market for pure EVs was still tiny - accounting for less than 1% of sales in 2016 - it had grown so quickly that Volvo Cars was the first to announce plans to switch to EV production. Owned by Chinese carmaker Geely since 2010, Volvo said it would stop producing vehicles powered solely by an internal combustion engine in 2019 and equip every model with an electric motor. Others followed suit. Jaguar Land Rover announced that all new models would come with the electrified option from 2020. Tesla, which produced only EVs, had launched its Model 3 with a base price of $35,000, designed for the mass market. With so much hype about hybrids and EVs, many car owners were concerned about the future value of their traditional combustion-engine vehicles. Like a computer on wheels, an EV is simpler and cheaper to produce than an internal combustion engine vehicle because it has far fewer parts. Employees of traditional carmakers were concerned too, as it was estimated that the demise of combustion engine cars could result in the loss of millions of jobs