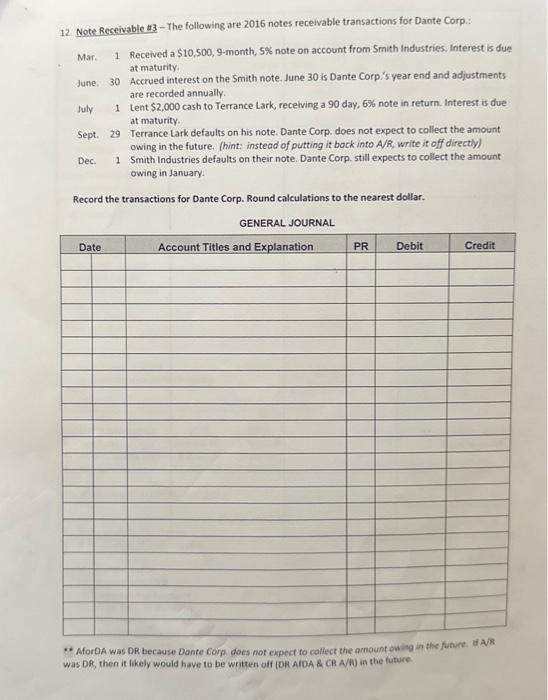

Question: 12. Note Receivable ( $ 3 ) - The following are 2016 notes receivable transactions for Dante Corp: Mar. 1 Received a ( $ 10,500,9

12. Note Receivable \\( \\$ 3 \\) - The following are 2016 notes receivable transactions for Dante Corp: Mar. 1 Received a \\( \\$ 10,500,9 \\)-month, \5 note on account from Smith Industries. Interest is due at maturity. June. 30 Accrued interest on the Smith note. June 30 is Dante Corp.'s year end and adjustments are recorded annually. July 1 Lent \\( \\$ 2,000 \\) cash to Terrance Lark, recehing a 90 day, \6 note in return. Interest is due at maturity. Sept. 29 Terrance Lark defaults on his note. Dante Corp. does not expect to collect the amount owing in the future. (hint: instead of putting it bock into \\( A / R \\), write it off directly) Dec. 1 Smith Industries defaults on their note. Dante Corp. still expects to collect the amount owing in January. Record the transactions for Dante Corp. Round calculations to the nearest dollar. GENERAL JOURNAL * AforDA was DR because Dante Corp does not expect to collect the amount was DR, then it likely would have to be written off (DA AIDA \\& CR A/N) in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts