Question: 12 Optimization Practice Problems 10. A Tax Planning Problem Topics: Capitial budgeting, multiperiod cash flow formulation, interpretation of dual prices Difficulty: High DevCor is a

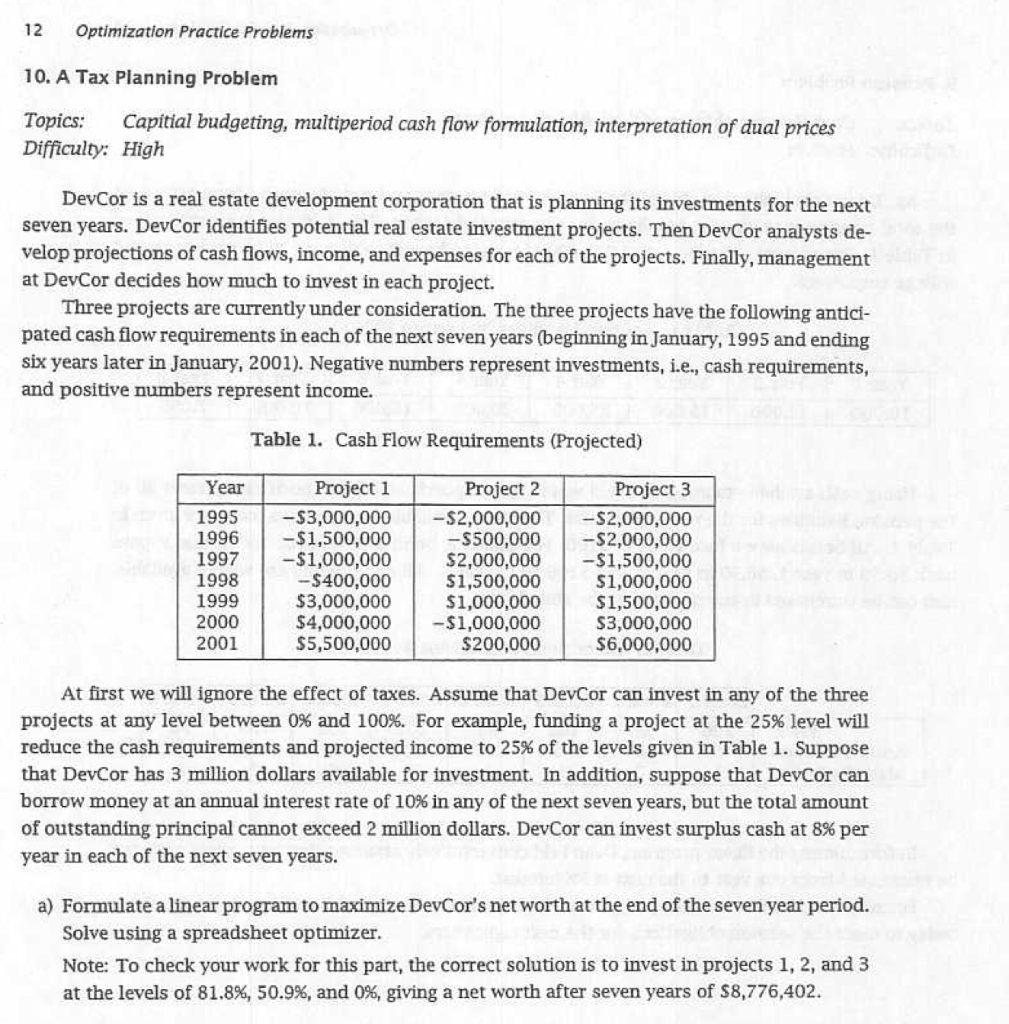

12 Optimization Practice Problems 10. A Tax Planning Problem Topics: Capitial budgeting, multiperiod cash flow formulation, interpretation of dual prices Difficulty: High DevCor is a real estate development corporation that is planning its investments for the next seven years. DevCor identifies potential real estate investment projects. Then DevCor analysts de- velop projections of cash flows, income, and expenses for each of the projects. Finally, management at DevCor decides how much to invest in each project. Three projects are currently under consideration. The three projects have the following antici- pated cash flow requirements in each of the next seven years (beginning in January, 1995 and ending six years later in January, 2001). Negative numbers represent investments, i.e., cash requirements, and positive numbers represent income. Table 1. Cash Flow Requirements (Projected) Year 1995 1996 1997 1998 1999 2000 2001 Project 1 -$3,000,000 -$1,500,000 -$1,000,000 -$400,000 $3,000,000 $4,000,000 $5,500,000 Project 2 -$2,000,000 -$500,000 $2,000,000 $1,500,000 $1,000,000 -$1,000,000 $200,000 Project 3 -$2,000,000 -$2,000,000 -$1,500,000 $1,000,000 $1,500,000 $3,000,000 $6,000,000 At first we will ignore the effect of taxes. Assume that DevCor can invest in any of the three projects at any level between 0% and 100%. For example, funding a project at the 25% level will reduce the cash requirements and projected income to 25% of the levels given in Table 1. Suppose that DevCor has 3 million dollars available for investment. In addition, suppose that DevCor can borrow money at an annual interest rate of 10% in any of the next seven years, but the total amount of outstanding principal cannot exceed 2 million dollars. DevCor can invest surplus cash at 8% per year in each of the next seven years. a) Formulate a linear program to maximize DevCor's net worth at the end of the seven year period. Solve using a spreadsheet optimizer. Note: To check your work for this part, the correct solution is to invest in projects 1, 2, and 3 at the levels of 81.8%, 50.9%, and 0%, giving a net worth after seven years of $8,776,402. 12 Optimization Practice Problems 10. A Tax Planning Problem Topics: Capitial budgeting, multiperiod cash flow formulation, interpretation of dual prices Difficulty: High DevCor is a real estate development corporation that is planning its investments for the next seven years. DevCor identifies potential real estate investment projects. Then DevCor analysts de- velop projections of cash flows, income, and expenses for each of the projects. Finally, management at DevCor decides how much to invest in each project. Three projects are currently under consideration. The three projects have the following antici- pated cash flow requirements in each of the next seven years (beginning in January, 1995 and ending six years later in January, 2001). Negative numbers represent investments, i.e., cash requirements, and positive numbers represent income. Table 1. Cash Flow Requirements (Projected) Year 1995 1996 1997 1998 1999 2000 2001 Project 1 -$3,000,000 -$1,500,000 -$1,000,000 -$400,000 $3,000,000 $4,000,000 $5,500,000 Project 2 -$2,000,000 -$500,000 $2,000,000 $1,500,000 $1,000,000 -$1,000,000 $200,000 Project 3 -$2,000,000 -$2,000,000 -$1,500,000 $1,000,000 $1,500,000 $3,000,000 $6,000,000 At first we will ignore the effect of taxes. Assume that DevCor can invest in any of the three projects at any level between 0% and 100%. For example, funding a project at the 25% level will reduce the cash requirements and projected income to 25% of the levels given in Table 1. Suppose that DevCor has 3 million dollars available for investment. In addition, suppose that DevCor can borrow money at an annual interest rate of 10% in any of the next seven years, but the total amount of outstanding principal cannot exceed 2 million dollars. DevCor can invest surplus cash at 8% per year in each of the next seven years. a) Formulate a linear program to maximize DevCor's net worth at the end of the seven year period. Solve using a spreadsheet optimizer. Note: To check your work for this part, the correct solution is to invest in projects 1, 2, and 3 at the levels of 81.8%, 50.9%, and 0%, giving a net worth after seven years of $8,776,402

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts