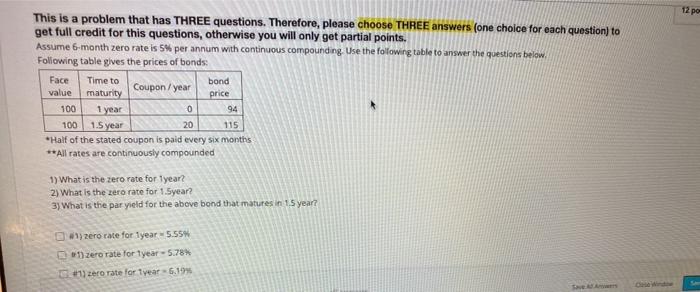

Question: 12 po This is a problem that has THREE questions. Therefore, please choose THREE answers (one choice for each question) to get full credit for

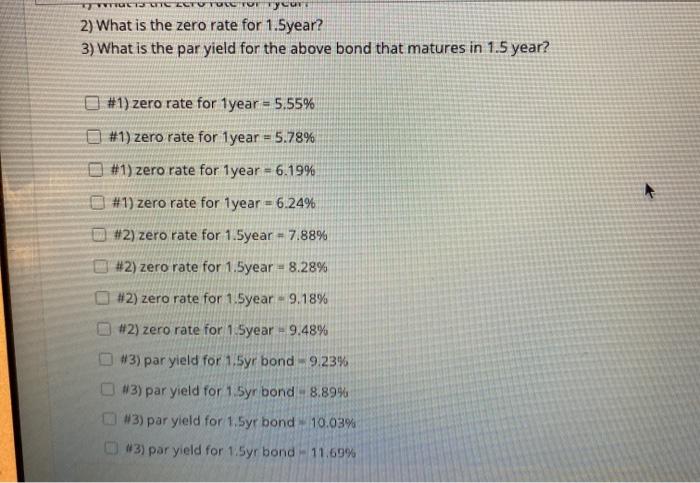

12 po This is a problem that has THREE questions. Therefore, please choose THREE answers (one choice for each question) to get full credit for this questions, otherwise you will only get partial points. Assume 6-month zero rate is 5% per annum with continuous compounding Use the following table to answer the questions below. Following table gives the prices of bonds: Face Time to Coupon/year bond value maturity price 100 1 year 100 1.5 year 20 115 *Half of the stated coupon is paid every six months **All rates are continuously compounded 0 94 1) What is the zero rate for Tyear? 2) What is the zero rate for 1.5year? 3) What is the par yield for the above bond that matures in 15 year? 1) zero rate for 1year 5.55% 1) zero rate for tyear - 5.78 1) zero rate for tyear -6.19% VTT 2) What is the zero rate for 1.5year? 3) What is the par yield for the above bond that matures in 1.5 year? #1) zero rate for 1year = 5.55% #1) zero rate for 1year = 5.78% #1) zero rate for 1year = 6.19% De #1) zero rate for 1year = 6.24% #2) zero rate for 1.5year = 7.88% #2) zero rate for 1.5year = 8.28% #2) zero rate for 1.5year - 9.18% #2) zero rate for 1.5year - 9.48% #3) par yield for 1.5yr bond 9.23% #3) par yield for 1.5yr bond 8.89% 3) par yield for 1.5yr bond 10.03% #3) par yield for 1.5yr bond - 11.69%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts