Question: 12) Suppose that the information presented in the previous problem was altered so that Beaver Inc.'s investment in Big Lion Corporation was not accounted for

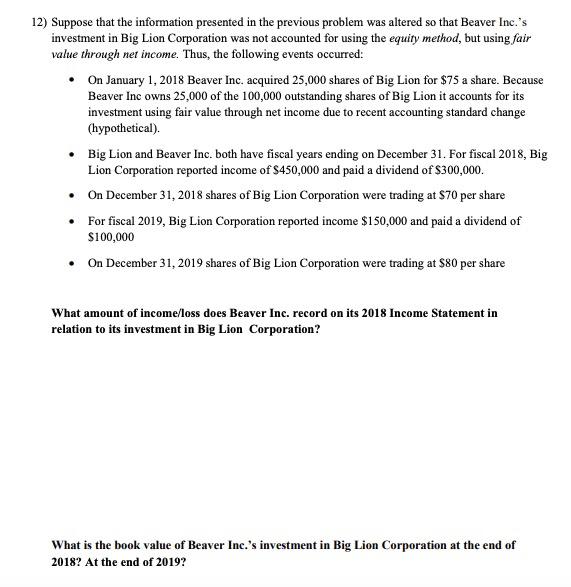

12) Suppose that the information presented in the previous problem was altered so that Beaver Inc.'s investment in Big Lion Corporation was not accounted for using the equity method, but using fair value through net income. Thus, the following events occurred: On January 1, 2018 Beaver Inc. acquired 25,000 shares of Big Lion for $75 a share. Because Beaver Inc owns 25,000 of the 100,000 outstanding shares of Big Lion it accounts for its investment using fair value through net income due to recent accounting standard change (hypothetical). Big Lion and Beaver Inc. both have fiscal years ending on December 31. For fiscal 2018, Big Lion Corporation reported income of $450,000 and paid a dividend of $300,000. On December 31, 2018 shares of Big Lion Corporation were trading at $70 per share For fiscal 2019, Big Lion Corporation reported income $150,000 and paid a dividend of $100,000 On December 31, 2019 shares of Big Lion Corporation were trading at $80 per share What amount of income/loss does Beaver Inc. record on its 2018 Income Statement in relation to its investment in Big Lion Corporation? What is the book value of Beaver Inc.'s investment in Big Lion Corporation at the end of 2018? At the end of 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts