Question: 12) Using the allowance method, writing off an actual bad debt would include a: A) Debit to Bad Debt Expense. B) Credit to Accounts Receivable.

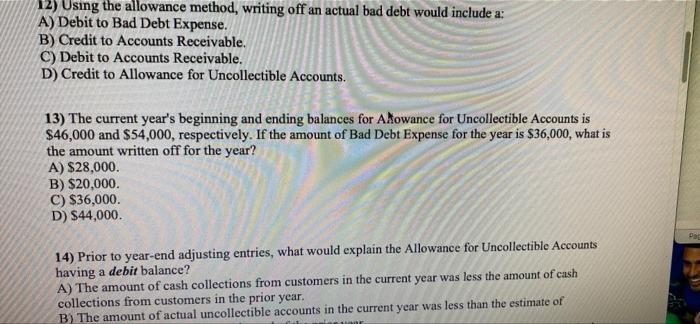

12) Using the allowance method, writing off an actual bad debt would include a: A) Debit to Bad Debt Expense. B) Credit to Accounts Receivable. C) Debit to Accounts Receivable. D) Credit to Allowance for Uncollectible Accounts. 13) The current year's beginning and ending balances for Alowance for Uncollectible Accounts is $46,000 and $54,000, respectively. If the amount of Bad Debt Expense for the year is $36,000, what is the amount written off for the year? A) $28,000. B) $20,000 C) $36,000. D) $44,000. BE 14) Prior to year-end adjusting entries, what would explain the Allowance for Uncollectible Accounts having a debit balance? A) The amount of cash collections from customers in the current year was less the amount of cash collections from customers in the prior year. B) The amount of actual uncollectible accounts in the current year was less than the estimate of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts