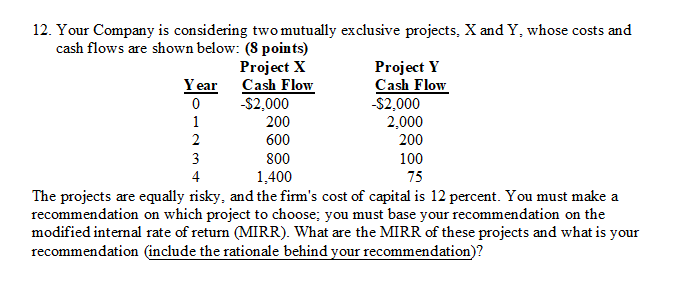

Question: 12. Your Company is considering two mutually exclusive projects, X and Y whose costs and cash flows are shown below: (8 points) Project X Project

12. Your Company is considering two mutually exclusive projects, X and Y whose costs and cash flows are shown below: (8 points) Project X Project Y Year Cash Flow Cash Flow 0 $2,000 $2,000 1 200 2,000 2 600 200 3 800 100 4 1,400 The projects are equally risky, and the firm's cost of capital is 12 percent. You must make a recommendation on which project to choose; you must base your recommendation on the modified internal rate of return (MIRR). What are the MIRR of these projects and what is your recommendation (include the rationale behind your recommendation)? 75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts