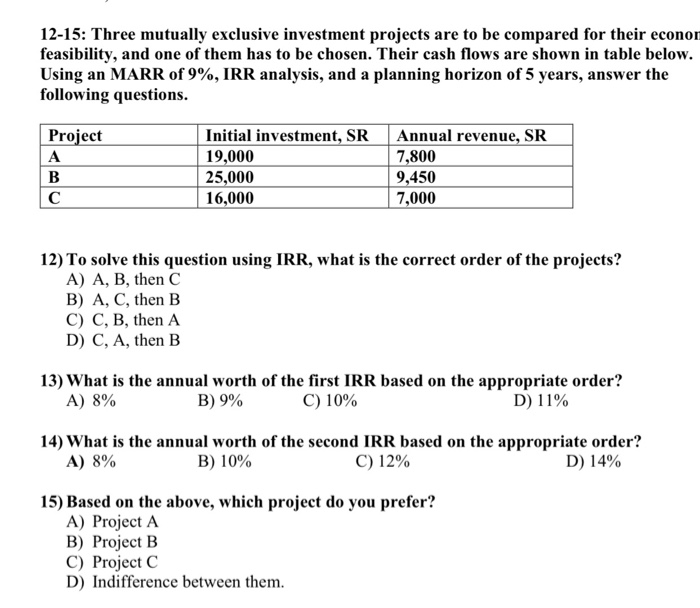

Question: 12-15: Three mutually exclusive investment projects are to be compared for their econor feasibility, and one of them has to be chosen. Their cash flows

12-15: Three mutually exclusive investment projects are to be compared for their econor feasibility, and one of them has to be chosen. Their cash flows are shown in table below. Using an MARR of 9%, IRR analysis, and a planning horizon of 5 years, answer the following questions. Project A B Initial investment, SR 19,000 25,000 16,000 Annual revenue, SR 7,800 9,450 7,000 12) To solve this question using IRR, what is the correct order of the projects? A) A, B, then C B) A, C, then B C) C, B, then A D) C, A, then B 13) What is the annual worth of the first IRR based on the appropriate order? A) 8% B) 9% C) 10% D) 11% 14) What is the annual worth of the second IRR based on the appropriate order? A) 8% B) 10% C) 12% D) 14% 15) Based on the above, which project do you prefer? A) Project A B) Project B C) Project C D) Indifference between them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts