Question: 123 NEED JUST PERFECT ANSWERS NO SOLUTION NEEDED. ( ) 1. A call option on a stock is said to be out of the money

123 NEED JUST PERFECT ANSWERS NO SOLUTION NEEDED.

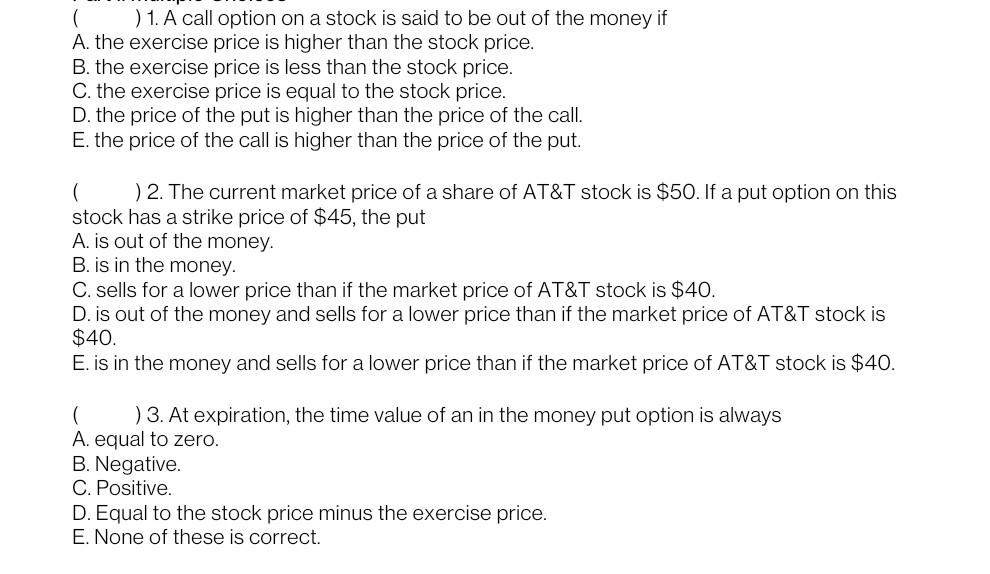

( ) 1. A call option on a stock is said to be out of the money if A. the exercise price is higher than the stock price. B. the exercise price is less than the stock price. C. the exercise price is equal to the stock price. D. the price of the put is higher than the price of the call. E. the price of the call is higher than the price of the put. ( ) 2. The current market price of a share of AT&T stock is $50. If a put option on this stock has a strike price of $45, the put A. is out of the money. B. is in the money. C. sells for a lower price than if the market price of AT&T stock is $40. D. is out of the money and sells for a lower price than if the market price of AT&T stock is $40. E. is in the money and sells for a lower price than if the market price of AT&T stock is $40. ( ) 3. At expiration, the time value of an in the money put option is always A. equal to zero. B. Negative. C. Positive. D. Equal to the stock price minus the exercise price. E. None of these is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts