Question: 456 NEED JUST PERFECT ANSWERS NO SOLUTION NEEDED. ( ) 4. Which one of the following variables influence the value of put options? 1) Level

456 NEED JUST PERFECT ANSWERS NO SOLUTION NEEDED.

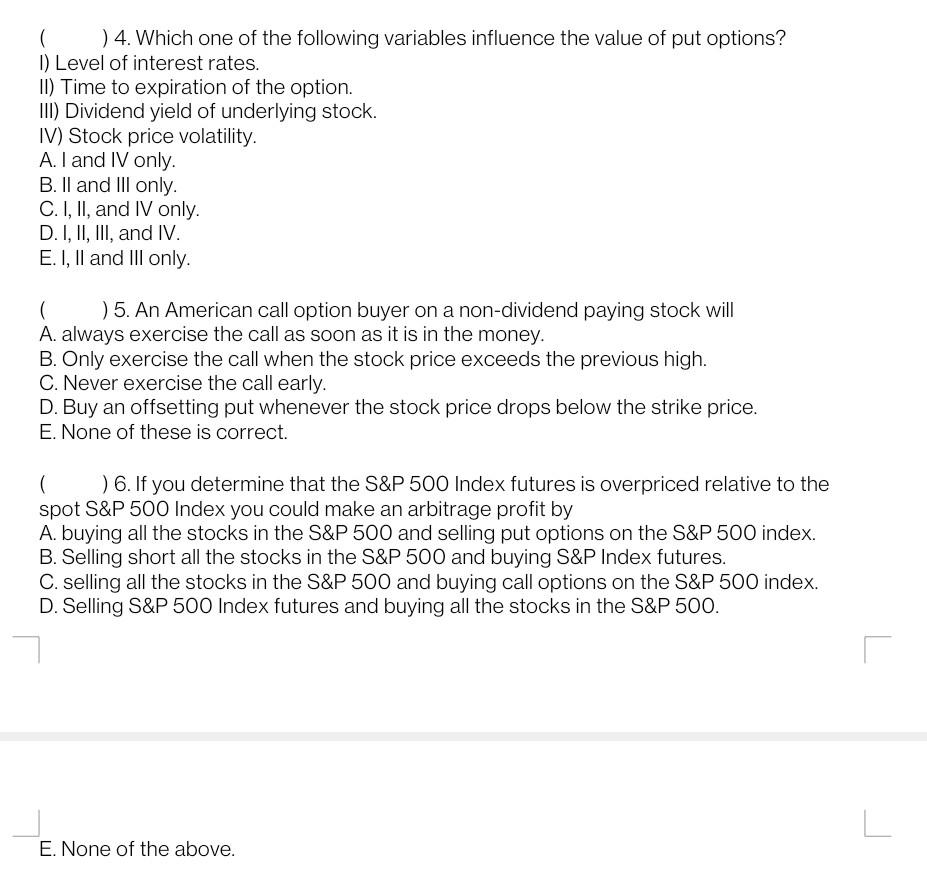

( ) 4. Which one of the following variables influence the value of put options? 1) Level of interest rates. II) Time to expiration of the option. III) Dividend yield of underlying stock. IV) Stock price volatility. A. I and IV only. B. II and III only. C. I, II, and IV only. D. I, II, III, and IV. E. I, II and III only. ( ) 5. An American call option buyer on a non-dividend paying stock will A. always exercise the call as soon as it is in the money. B. Only exercise the call when the stock price exceeds the previous high. C. Never exercise the call early. D. Buy an offsetting put whenever the stock price drops below the strike price. E. None of these is correct. ( ) 6. If you determine that the S&P 500 Index futures is overpriced relative to the spot S&P 500 Index you could make an arbitrage profit by A. buying all the stocks in the S&P 500 and selling put options on the S&P 500 index. B. Selling short all the stocks in the S&P 500 and buying S&P Index futures. C. selling all the stocks in the S&P 500 and buying call options on the S&P 500 index. D. Selling S&P 500 Index futures and buying all the stocks in the S&P 500. L E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts