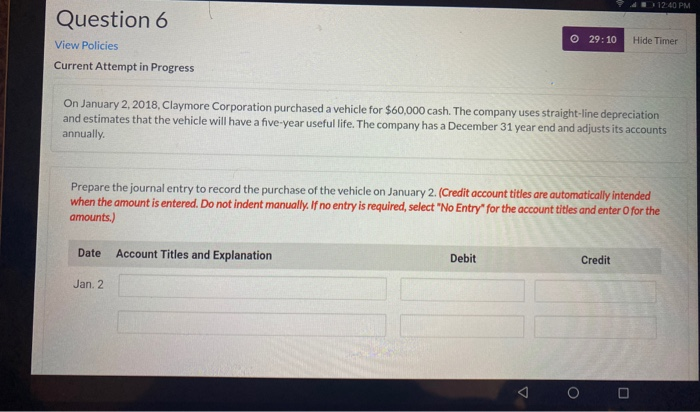

Question: 12:40 PM Question 6 29:10 Hide Timer View Policies Current Attempt in Progress On January 2, 2018, Claymore Corporation purchased a vehicle for $60,000 cash.

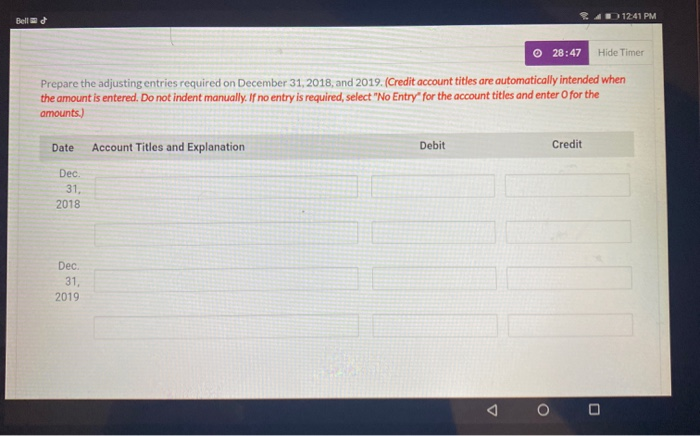

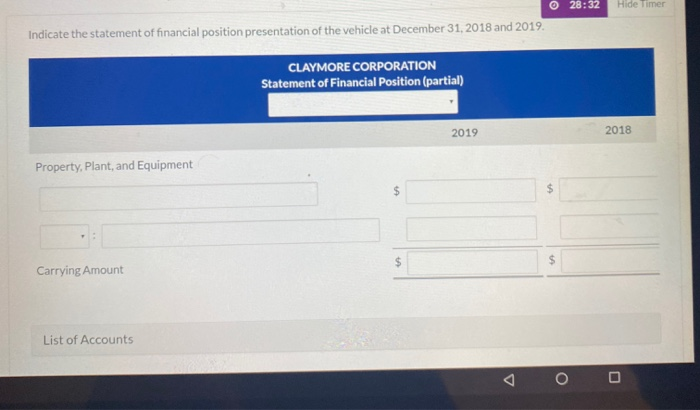

12:40 PM Question 6 29:10 Hide Timer View Policies Current Attempt in Progress On January 2, 2018, Claymore Corporation purchased a vehicle for $60,000 cash. The company uses straight-line depreciation and estimates that the vehicle will have a five-year useful life. The company has a December 31 year end and adjusts its accounts annually. Prepare the journal entry to record the purchase of the vehicle on January 2. (Credit account titles are automatically intended when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2 Belld 12:41 PM 28:47 Hide Timer Prepare the adjusting entries required on December 31, 2018, and 2019. (Credit account titles are automatically intended when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31. 2018 Dec. 31 2019 28:32 Hide Timer Indicate the statement of financial position presentation of the vehicle at December 31, 2018 and 2019. CLAYMORE CORPORATION Statement of Financial Position (partial) 2019 2018 Property, Plant, and Equipment S $ $ Carrying Amount List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts