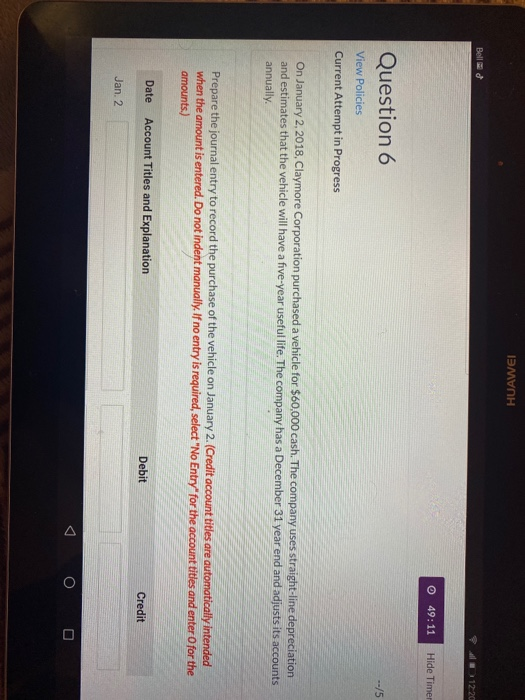

Question: IPMVOH Bell 1220 O 49:11 Hide Timer Question 6 --/5 View Policies Current Attempt in Progress On January 2, 2018, Claymore Corporation purchased a vehicle

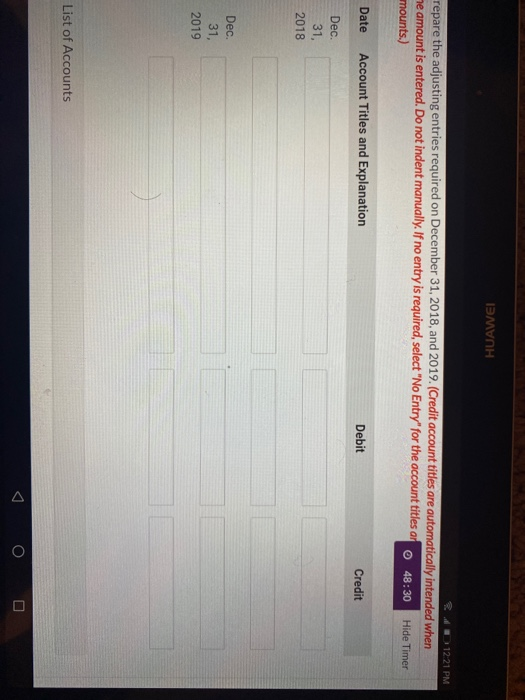

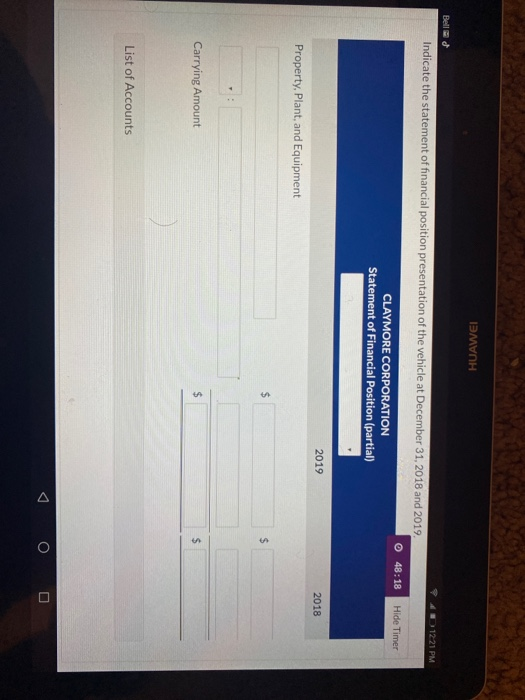

IPMVOH Bell 1220 O 49:11 Hide Timer Question 6 --/5 View Policies Current Attempt in Progress On January 2, 2018, Claymore Corporation purchased a vehicle for $60,000 cash. The company uses straight-line depreciation and estimates that the vehicle will have a five-year useful life. The company has a December 31 year end and adjusts its accounts annually. Prepare the journal entry to record the purchase of the vehicle on January 2. (Credit account titles are automatically intended when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2 O IPMVOH 12:21 PM repare the adjusting entries required on December 31, 2018, and 2019. (Credit account titles are automatically intended when me amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles ar mounts.) 048:30 Hide Timer Date Account Titles and Explanation Debit Credit Dec. 31, 2018 Dec. 31, 2019 List of Accounts O PMVOH Bell 1221 PM Indicate the statement of financial position presentation of the vehicle at December 31, 2018 and 2019. 48:18 Hide Timer CLAYMORE CORPORATION Statement of Financial Position (partial) 2019 2018 Property, Plant, and Equipment $ Carrying Amount $ $ List of Accounts O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts