Question: 125% 1 Insert T Text Zoom Add Table Chart Shape Media Commons Chapter 3: Capital Budgeting Question 5 (20m) Galdrums Ltd s trying to decide

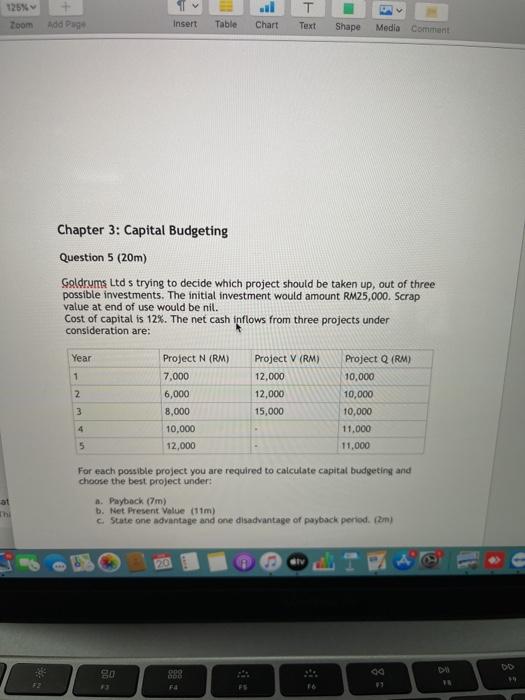

125% 1 Insert T Text Zoom Add Table Chart Shape Media Commons Chapter 3: Capital Budgeting Question 5 (20m) Galdrums Ltd s trying to decide which project should be taken up, out of three possible investments. The initial investment would amount RM25,000. Scrap value at end of use would be nil. Cost of capital is 12%. The net cash inflows from three projects under consideration are: Year 1 Project N (RM) 7,000 6,000 8,000 10,000 12,000 Project V (RM) 12,000 12,000 15,000 2 Project Q (RM) 10,000 10,000 10,000 11,000 11,000 3 4 5 at For each possible project you are required to calculate capital budgeting and choose the best project under: A. Payback (m) b. Net Present Value (11m) State one advantage and one disadvantage of payback period. (2) 20 DO Dll 90 DOO ***

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts