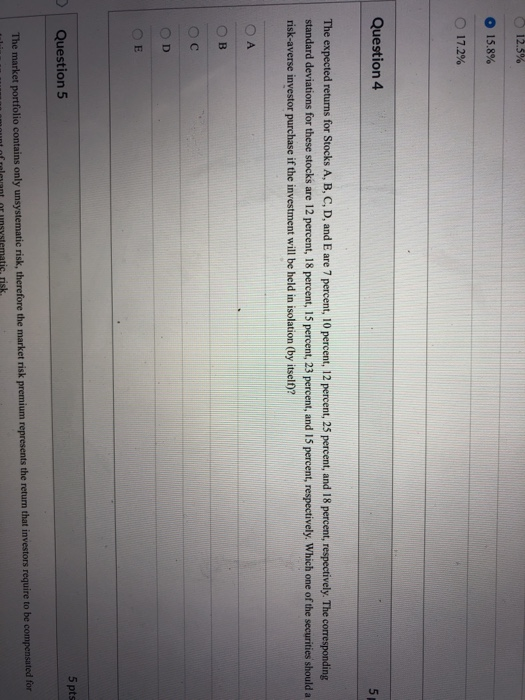

Question: 12.5% O 15.8% 17.2% Question 4 The expected returns for Stocks A, B, C, D, and E are 7 percent, 10 percent, 12 percent, 25

12.5% O 15.8% 17.2% Question 4 The expected returns for Stocks A, B, C, D, and E are 7 percent, 10 percent, 12 percent, 25 percent, and 18 percent, respectively. The corresponding standard deviations for these stocks are 12 percent, 18 percent, 15 percent, 23 percent, and 15 percent, respectively. Which one of the securities should a risk-averse investor purchase if the investment will be held in isolation (by itself? oc OD 5 pts Question 5 The market portfolio contains only unsystematic risk, therefore the market risk premium represents the return that investors require to be compensated for al amount of relevant or systematis, risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts