Question: #19 E. Capital asset pricing model 18. Systematic risk is defined as: A. any risk that affects a large number of assets B. the total

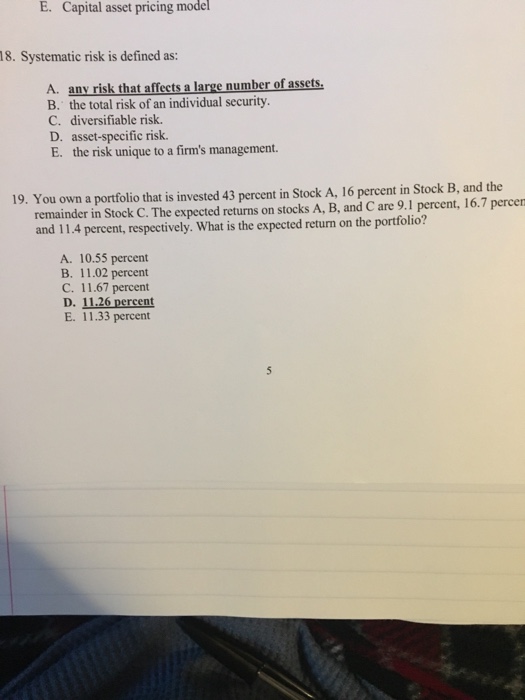

E. Capital asset pricing model 18. Systematic risk is defined as: A. any risk that affects a large number of assets B. the total risk of an individual security C. diversifiable risk. asset-specific risk. the risk unique to a firm's management. D. E. 19. You own a portfolio that is invested 43 percent in Stock A, 16 percent in Stock B, and the remainder in Stock C. The expected returns on stocks A, B, and C are 9.1 percent, 16.7 percen and 11.4 percent, respectively. What is the expected return on the portfolio? A. 10.55 percent B. 11.02 percent C. 11.67 percent D. 11.26 percent E. 11.33 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts