Question: 125% View . Zoom Insect Table Add Category Exercise 1 Exercise 2 Chart + Short Answer Exercise 3 Exercise 4 P Corporation manufactures two products:

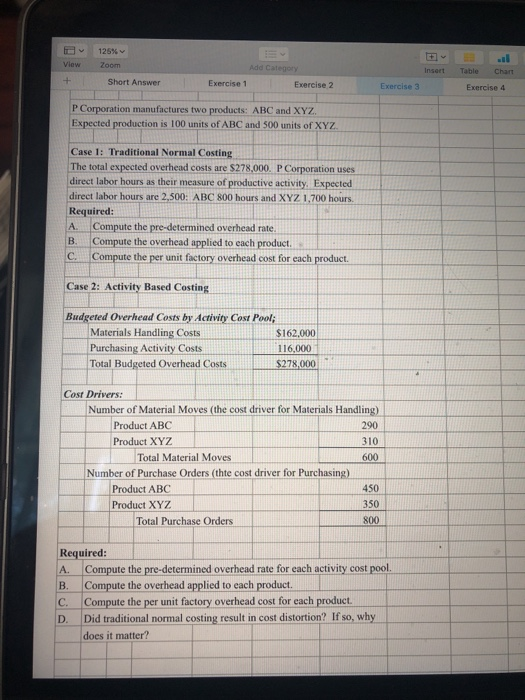

125% View . Zoom Insect Table Add Category Exercise 1 Exercise 2 Chart + Short Answer Exercise 3 Exercise 4 P Corporation manufactures two products: ABC and XYZ. Expected production is 100 units of ABC and 500 units of XYZ Case 1: Traditional Normal Costing The total expected overhead costs are $278,000. P Corporation uses direct labor hours as their measure of productive activity. Expected direct labor hours are 2,500: ABC 800 hours and XYZ 1,700 hours Required: A Compute the pre-determined overhead rate. B Compute the overhead applied to each product. C. Compute the per unit factory overhead cost for each product. Case 2: Activity Based Costing Budgeted Overhead Costs by Activity Cost Pool; Materials Handling Costs $162.000 Purchasing Activity Costs 116,000 Total Budgeted Overhead Costs $278,000 Cost Drivers: Number of Material Moves (the cost driver for Materials Handling) Product ABC 290 Product XYZ 310 Total Material Moves 600 Number of Purchase Orders (thte cost driver for Purchasing) Product ABC 450 Product XYZ 350 Total Purchase Orders 800 Required: A Compute the pre-determined overhead rate for each activity cost pool. B. Compute the overhead applied to each product. C. Compute the per unit factory overhead cost for each product. D. Did traditional normal costing result in cost distortion? If so, why does it matter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts