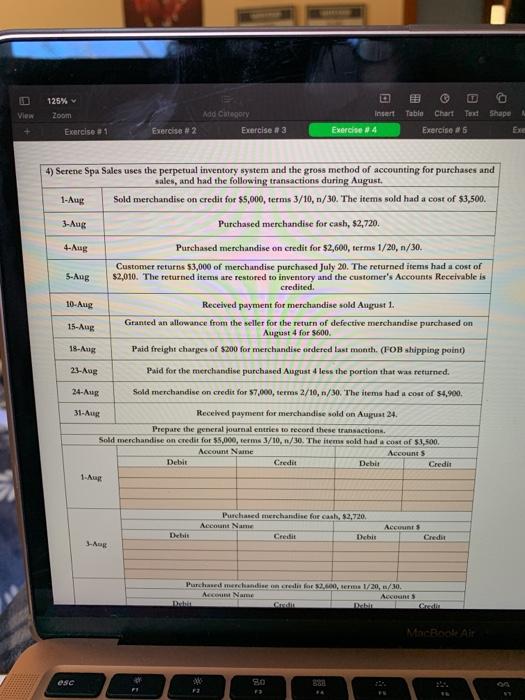

Question: 125% View Zoom Table Chart Text Shape Add Category Exercise #3 Exercise #1 Exercise #2 Exercise 4 Exercise #6 4-Aug 4) Setene Spa Sales uses

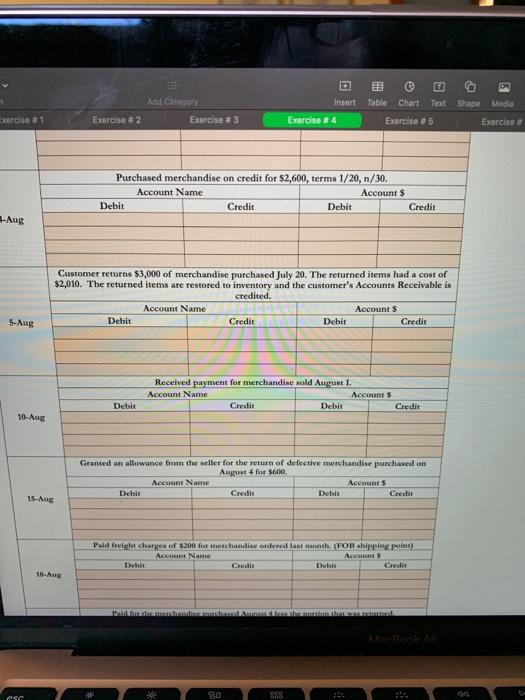

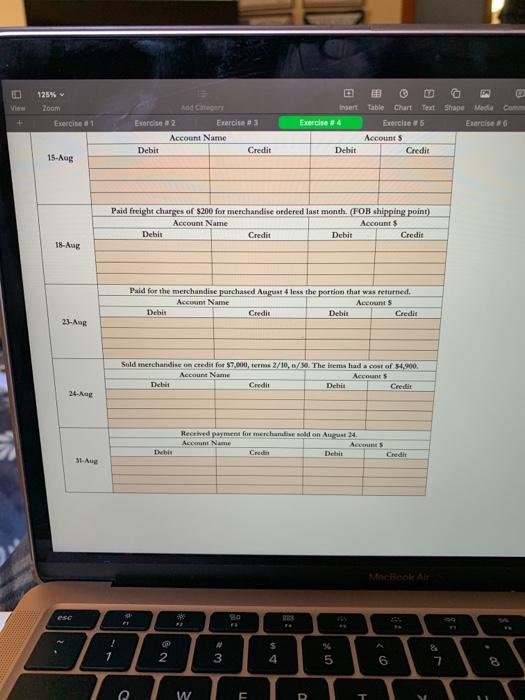

125% View Zoom Table Chart Text Shape Add Category Exercise #3 Exercise #1 Exercise #2 Exercise 4 Exercise #6 4-Aug 4) Setene Spa Sales uses the perpetual inventory system and the gross method of accounting for purchases and sales, and had the following transactions during August. 1-Aug Sold merchandise on credit for $5,000, terms 3/10, 1/30. The items sold had a cost of $3,500. 3-Aug Purchased merchandise for cash, $2,720. Purchased merchandise on credit for $2,600, terms 1/20, n/30. Customer returns $3,000 of merchandise purchased July 20. The returned items had a cost of S-Aug $2,010. The returned items are restored to inventory and the customer's Accounts Receivable is credited. 10-Aug Received payment for merchandise sold August 1. 15-Aug Granted an allowance from the seller for the return of defective merchandise purchased on August 4 for $600. Paid freight charges of $200 for merchandise ordered last month. (FOB shipping point) 23-Aug Paid for the merchandise purchased August 4 less the portion that was returned. 24-Aug Sold merchandise on credit for 57,000, terms 2/10, /30. The items had cost of $4,900. 31-Aug Received payment for merchandise sold on August 24. Prepare the general journal entries to record these transactions. Sold merchandise on credit for $5,000, terms 3/10, 1/30. The items sold had a cost of $3,500. Account Naine Accounts Debit Credit Deblo Credit 1-AR 18-Aug Purchased merchandise for cash, $2,720 Account Name Credit Debis Debit Accus Crede -Aug Purchased mechandise on crede for me 1/20/30 Acc Name Accounts Rubin esc Insert Table Chart Text Shape Media Add Category Exercise #3 xercise #1 Exercise #2 Exercise #4 Exercise #5 Exercise Purchased merchandise on credit for $2,600, terms 1/20, n/30. Account Name Accounts Debit Credit Debit Credit -Aug Customer returns $3,000 of merchandise purchased July 20. The returned items had a cost of $2,010. The returned items are restored to inventory and the customer's Accounts Receivable is credited. Account Name Accounts Debit Credit Debit Credit 5-Aug Received payment for merchandise sold August 1. Account Name Accounts Credit Debit Credit Debic 10-Aug Granted an allowance from the seller for the return of defective merchandise purchased on August 4 for $600 Account Name Accounts Debi Credit Debit Credit 15-Aug Pald freight charges of $200 for merchandise ardered last month (FOR shipping point) Act Nam Account Det Credi Dubi illumitrinilunthaaal. AS DO ER 125% Zoom Exercise 81 Add Clear Estrise 2 Exercite 3 Account Name Debit Credit insert Table Chart Text Shape Made Exercise #4 Exercise 6 Exercise Accounts Debit Credit 15-Aug Paid freight charges of $200 for merchandise ordered last month. (FOB shipping point) Account Name Accounts Debit Credit Debit Credit 18-Aug Paid for the merchandise purchased August 4 less the portion that was returned Account Name Accounts Debis Credit Dehir Credit 23-Ang Sold merchandise on credit for $7.000, terms 2/10, 1/. The items had a cost of $4.900 Account Name Accounts Debit Credit Dchi Credit 24-Aug Received payment for merchandise sold on August 24 Ace Name Accues Credit Debit Credit Thebi SL Aug esc a . 1 2 3 4 5 6 7 8 T w D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts