Question: 12-58 MACRS Depreciation and Capital-Budgeting Analysis; Spreadsheet Application; Sensitivity Analysis You and your spouse have recently inherited money from a distant relative and are considering

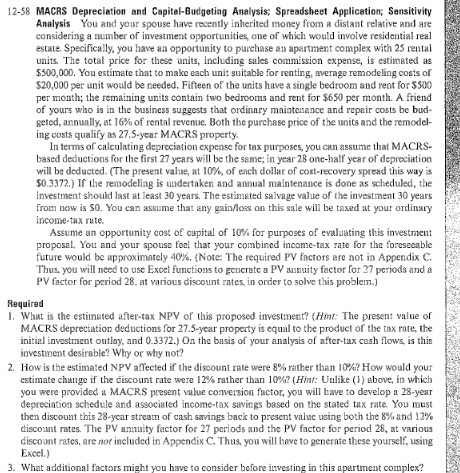

12-58 MACRS Depreciation and Capital-Budgeting Analysis; Spreadsheet Application; Sensitivity Analysis You and your spouse have recently inherited money from a distant relative and are considering a number of investment opportunities, one of which would involve residential real estate. Specifically, you have an opportunity to purchase an apartment complex with 25 rental units. The total price for these units, including sales commission expense, is estimated as $500,000. You estimate that to make each unit suitable for renting, average remodeling costs of $20,000 per unit would be needed. Fifteen of the units have a single bedroom and rent for $500 per month; the remaining units contain two bedrooms and rent for $650 per month. A friend of yours who is in the business suggests that ordinary maintenance and repair costs be bud- geted, annually, at 16%% of rental revenue. Both the purchase price of the units and the remodel- ing ousts qualify as 27.5-year MACRS property. In terms of calculating depreciation expense for tax purposes, you can assume that MACRS- based deductions for the first 27 years will be the same; in year 28 one-half year of depreciation will be deducted. (The present value, at 10%, of each dollar of cost-recovery spread this way is $0.3372.) If the remodeling is mudertaken and annual maintenance is done as scheduled, the investment should last at least 30 years. The estimated salvage value of the investment 30 years from now is 50. You can assume that any gain/loss on this sale will be taxed at your ordinary income-tax rate. Assume an opportunity cost of capital of 10% for purposes of evaluating this investment proposal, You and your spouse feel that your combined income-tax rate for the foreseeable future would be approximately 40%. (Note: The required PV factors are not in Appendix C. Thus. you will need to use Excel functions to generate a PV annuity factor for 37 periods and a PV factor for period 28. at various discount rates, in order to solve this problem.] Required I. What is the estimated after-tax NPV of this proposed investment? (How: The present value of MACKS depreciation deductions for 27.5-year property is equal to the product of the tax rate, the initial investment outlay, and 0.3372.) On the basis of your analysis of after-tax cush flows. is this investment desirable? Why or why not? 2. How is the estimated NPV affected if the discount rate were 8% rather than 10%? How would your estimate chango if the discount rate were 12% rather than 10%? (Hint: Unlike (1) above, in which you were provided a MACRS present value conversion factor, you will have to develop a 28-year depreciation schedule and associated income-tax savings based on the stated tax rate. You must then discount this 28-year stream of cash savings back to present value using both the 8% and 12% discount rates. The PV annuity factor for 27 periods and the PV factor for period 28, at various discount rates, are not included in Appendix C. Thus you will have to generate these yourself, using Excel.) What additional factors might you have to consider before investing in this apartment complex