Question: S interest. PROBLEM 4: MULTIPLE CHOICE - COMPUTATIONAL 1. A, B and C with profit and loss sharing ratio of 4:3:3, respectively, have the following

- how sh and the much should Angry invest if the amount of investment must 3 interest i reflect the fair value of the interest acquired?

- how much is the adjusted capital balance of Sad after the admission of Angry? infusion

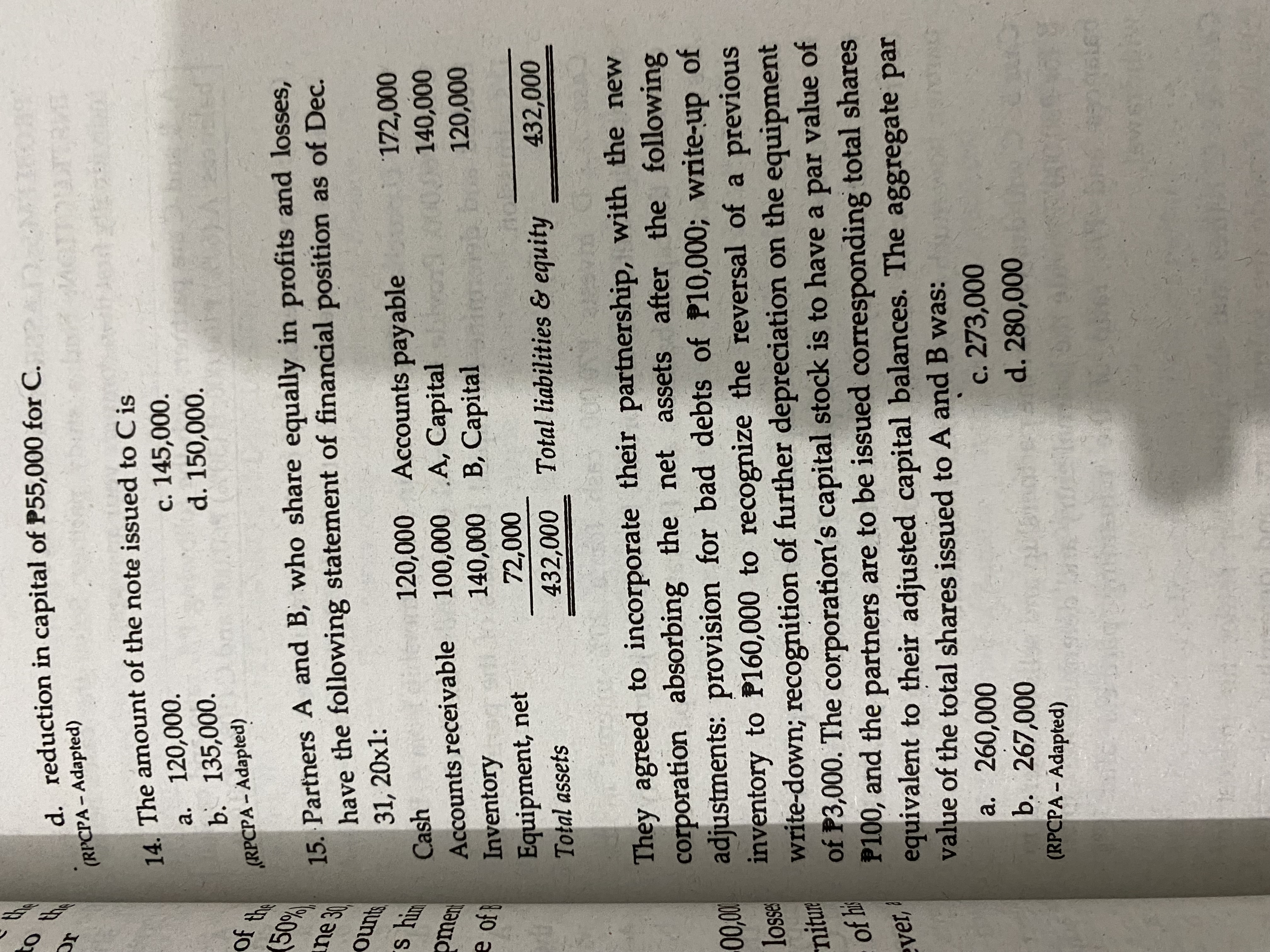

- er Andre a. 20,000 20,000 C. 20,000 24,000 g, Piw and b. 25,000 20,000 d. 25,000 16,000 10. Kern and Pate are partners with capital balances of P60,000 and P20,000, respectively. Profits and losses are divided in the ratio of 60:40. Kern and Pate decided to form a new partnership with Grant, who invested land valued at P15,000 for a 20% capital interest in the new partnership. Grant's cost96 of the land was P12,000. The partnership elected to use it bonus method to record the admission of Grant into the the amount of partnership. Grant's capital account should be credited for c. 16,000. 120, 000. a. 12,000. d. 19,000. 135000. b. 15,000. Partners A and B, who share (AICPA) have the following statement 11. The net assets of ABC Co. as of July 1, 20x1 consists of the following: A (20%), P300,000; B (30%), P500,000; and C (50%) 120,000 P200,000. Profit of P1,800,000 for the six months ended June 30 100,000 20x1 is not yet closed to partners' respective capital accounts 140,000 C withdraws on July 1, 20x1 and the partnership pays him Accounts receivable P1,000,000 cash and gives him fully depreciated equipment 72,000 with fair value of P600,000. What is the capital balance of B 432,000 right after C's withdrawal? quipment net a. 780,000 c. 700,000 b. 1,220,000 d. 1,100,000 They agreed to incorporate Use the following information for the next three items: corporation absorbing the A, B and C are partners with capital balances of P300,000, P300,000 adjustments: provision for b and P200,000, respectively. The partners share in profits and losses inventory to P160,000 to rec equally. C is to retire and it is agreed that he would take furniture write-down; recognition of fu with carrying amount of P65,000 and a note for the balance of his of 23 0. The corporation's interest. The fair value of the furniture is P50,000; however, a brand-new furniture would cost P80,000. 1200, and the partners are to equivalent to their adjusted 12. C's acquisition of the furniture would result in value of the total shares issu a. reduction in capital of P15,000 each for A and B. a. 260,000 b. reduction in capital of P10,000 for C. b. 267 000 RPCPA- Adapted c. reduction in capital of P5,000 each for A, B and C. (RPCPA - Adapted) d. reduction in capital of P7,500 each for A and B. 13. C's acquisition of the furniture would result in a. reduction in capital of P5,000 each for A and B only. b. reduction in capital of P7,500 each for A and B only. c. reduction in capital of P15,000 for C.d. reduction in capital of P55,000 for C. (RPCPA - Adapted) 14. The amount of the note issued to C is a. 120,000. c. 145,000. b. 135,000. d. 150,000. of the (RPCPA - Adapted) (50% Ine 30 15. Partners A and B, who share equally in profits and losses, have the following statement of financial position as of Dec. ounts 31, 20x1: s him Cash 120,000 Accounts payable 172,000 pmen Accounts receivable 100,000 .A, Capital 140,000 e of R Inventory 140,000 B, Capital 120,000 Equipment, net 72,000 Total assets 432,000 Total liabilities & equity 432,000 They agreed to incorporate their partnership, with the new corporation absorbing the net assets after the following 00,000 adjustments: provision for bad debts of P10,000; write-up of losses inventory to P160,000 to recognize the reversal of a previous niture write-down; recognition of further depreciation on the equipment of his of P3,000. The corporation's capital stock is to have a par value of P100, and the partners are to be issued corresponding total shares ver, equivalent to their adjusted capital balances. The aggregate par value of the total shares issued to A and B was: a. 260,000 c. 273,000 b. 267,000 d. 280,000 (RPCPA - Adapted) SE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock