Question: 12:59 MB i derson instructure.com ! Question 8 1 pts Which of the following statements is CORRECT? Call options generally sell at a price greater

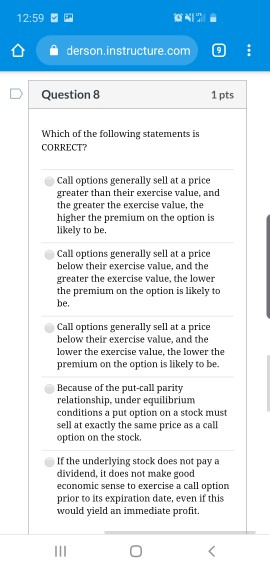

12:59 MB i derson instructure.com ! Question 8 1 pts Which of the following statements is CORRECT? Call options generally sell at a price greater than their exercise value, and the greater the exercise value, the higher the premium on the option is likely to be. Call options generally sell at a price below their exercise value, and the greater the exercise value, the lower the premium on the option is likely to be. Call options generally sell at a price below their exercise value, and the lower the exercise value, the lower the premium on the option is likely to be. Because of the put-call parity relationship, under equilibrium conditions a put option on a stock must sell at exactly the same price as a call option on the stock. If the underlying stock does not pay a dividend, it does not make good economic sense to exercise a call option prior to its expiration date, even if this would yield an immediate profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts