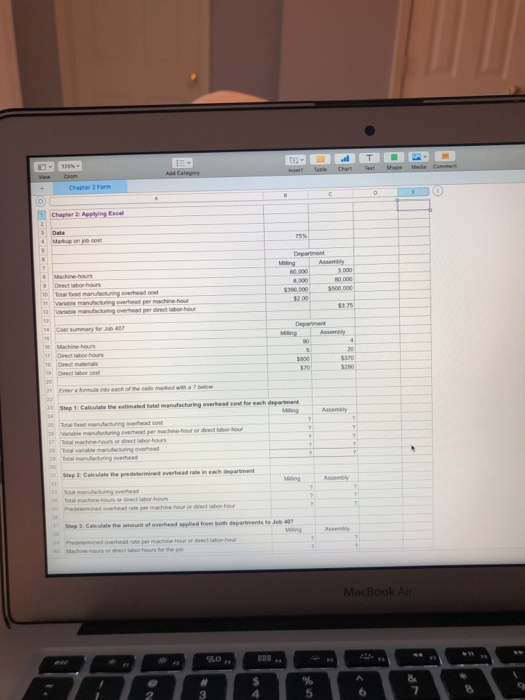

Question: 126%3 Comment Shape Media Ter Chart Tabler Inserts Add Categony Zoom View Chapter 2 Farm (O. Chapter 2: Applying Excel 3 Data 75% Markup on

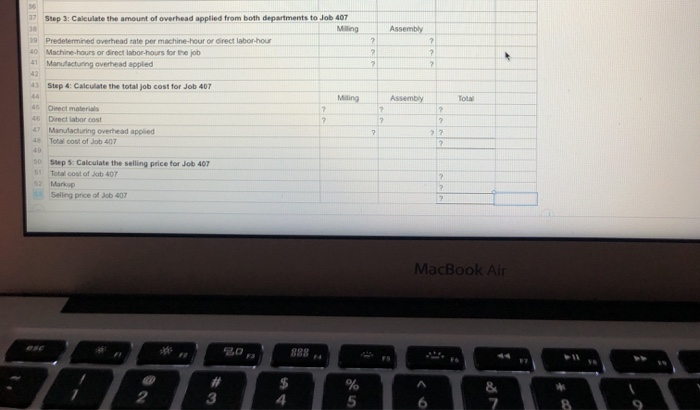

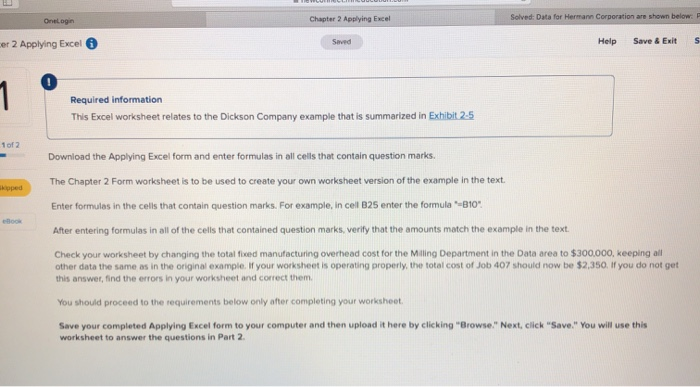

126%3 Comment Shape Media Ter Chart Tabler Inserts Add Categony Zoom View Chapter 2 Farm (O. Chapter 2: Applying Excel 3 Data 75% Markup on iob co Department Assembly Miling 60.000 8.00 $30,000 3000 Machine-hours 9Direct laborhours 10 Total fed manutacturing overhead cost 1Varible manufachuring overhead per machinehour 12 Vaatle manutachuing overhead per direct laborhour 80,000 s500 000 $2 00 $3.75 Depanment 4CoNt summary for Job 40 Assembly Ming 15 Machine-hours 17 Direct labor-hours 20 $370 $280 s00 18 Drect mateals 1Direct labor cos S70 20 2Erter a formua into each of the cells meked with a 7 below 23 23 Step 1: Calculate the estimated total manufacturing overhead cost for each departments 24 Assembly Miings 2s f manutacturing owerhead cos Vee manutactung overhead per machine-hour or drect laborbour 2 2 tal machinehours or direct laborhoaurs 2 Total vaable manulacturing overhead 2Total manuacturng overhead 30 aStep 2 Calculate the predetermined everhead rate in each degeartment Assembly Ming 3 Total manutacturing overhead 34Totel machine-hours or drect labor-hours Pedelemmined ovehead rte per machnehour or direct lsbor-hous Step 3 Calculate the amount of overhead spplied from both departments to Job 40 Ming Assembly Predtemined overheat te cer machine-hour or drect labor-hour 40 Machinetours or drec abor hours for the job MacBook Air esc A S % 6 5 4 3 2 36 37 Step 3: Calculate the amount of overhead applied from both departments to Job 407 Milling 38 Assembly 39 Predetermined overhead rate per machine-hour or direct labor-hour 40 Machine-hours or direct labor-hours for the job 41 Manufacturing overhead appled 42 43 Step 4: Calculate the total job cost for Job 407 44 Miling Assembly Total 45 Direct materials Direct labor cost Manufacturing overhead applied 48 Total cost of Job 407 47 217 Step 5: Calculate the selling price for Job 407 50 Total cost of Jab 407 52 Markup Sellng price of Job 407 MacBook Air ese 888 E3 % & 3 5 Solved: Data for Hermann Corporation are shown below: P Chapter 2 Applying Excel Onelogin Save & Exit Help cer 2 Applying Excel Saved 1 Required information This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5 1 of 2 Download the Applying Excel form and enter formulas in all cells that contain question marks. The Chapter 2 Form worksheet is to be used to create your own worksheet version of the example in the text. kipped B25 enter the formula "-B10 Enter formulas in the cells that contain question marks. For example, in cell eBook After entering formulas in all of the cells that contained question marks, verify that the amounts match the example in the text Check your worksheet by changing the total fixed manufacturing overhead cost for the Milling Department in the Data area to $300.000, keeping all other data the same as in the original example. If your worksheet is operating properly, the total cost of Job 407 should now be $2,350. If you do not get this answer, find the errors in your worksheet and correct them You should proceed to the requirements below only after completing your worksheet Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse." Next, click "Save." You will use this worksheet to answer the questions in Part 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts