Question: 13. (4 points) An investor set a portfolio using one-unit stock and one-unit option with a strike price of $30 to build a covered call

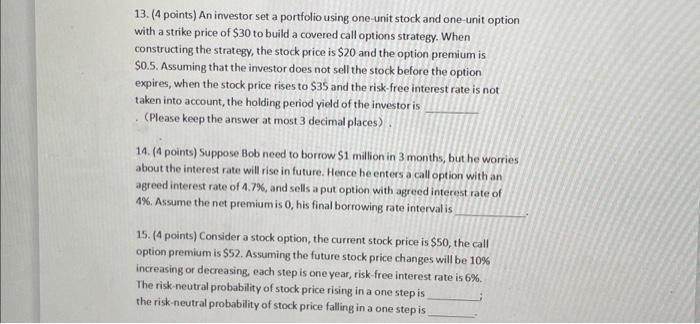

13. (4 points) An investor set a portfolio using one-unit stock and one-unit option with a strike price of $30 to build a covered call options strategy. When constructing the strategy, the stock price is $20 and the option premium is \$0.5. Assuming that the investor does not sell the stock before the option expires, when the stock price rises to $35 and the risk-free interest rate is not taken into account, the holding period yield of the investor is . (Please keep the answer at most 3 decimal places). 14. (A points) Suppose Bob need to borrow $1 million in 3 months, but he worries about the interest rate will rise in future. Hence he enters a call option with an agreed interest rate of 4.7%, and sells a put option with agreed interest rate of 4\%. Assume the net premium is 0 , his final borrowing rate interval is 15. ( 4 points) Consider a stock option, the current stock price is $50, the call option premium is \$52. Assuming the future stock price changes will be 10% increasing or decreasing, each step is oneyear, risk-free interest rate is 6%. The risk-neutral probability of stock price rising in a one step is the risk-neutral probability of stock price falling in a one step is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts