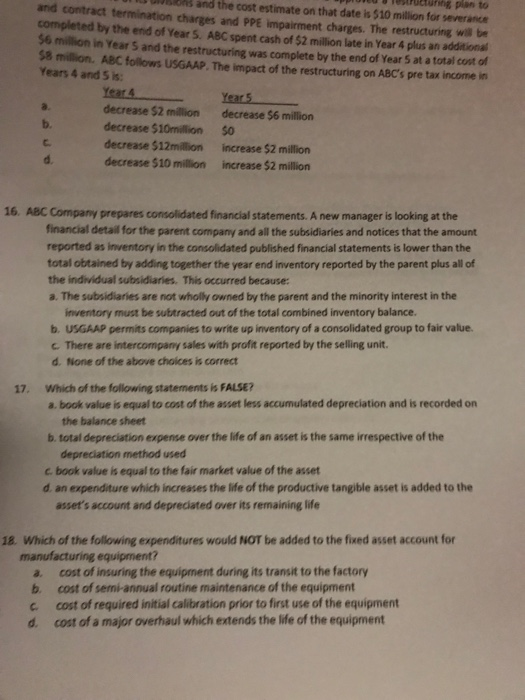

Question: 13 and the cost uring plan estimate on that date is $10 milion for severance termination charges and PPE impairment charges. The restructuring wil be

13 and the cost uring plan estimate on that date is $10 milion for severance termination charges and PPE impairment charges. The restructuring wil be completed by the end of Year 5. ABC spent cash of $2 million late in Year 4 plus an additional to and contract 36 million in Year 5 and the restructuring was complete by the end of Year 5 at a total cost of 38 million. ABC follows USGAAP. The impact of the restructuring on ABC's pre tax income in Years 4 and 5 is: Year 4 decrease $2 milliondecrease $6 million decrease $10million $0 decrease $12million increase $2 million decrease $10 million increase $2 million a. b. C. d. 16. ABC Company prepares consolidated financial statements. A new manager is looking at the financial detail for the parent company and all the subsidiaries and notices that the amount reported as inventory in the consolidated published financial statements is lower than the total ottained by adding together the year end inventory reported by the parent plus all of the individual subsidiaries. This occurred because a. The subsidiaries are not wholly owned by the parent and the minority interest in the inventory must be suttracted out of the total combined inventory balance. b. USGAAP permits companies to write up inventory of a consolidated group to fair value. c There are intercompany sales with profit reported by the selling unit. d. None of the above choices is correct Which of the following statements is FALSE? 17. a. book value is equal to cost of the asset less accumulated depreciation and is recorded on the balance sheet b. total depreciation expense over the life of an asset is the same irrespective of the depreciation method used c. book value is equal to the fair market value of the asset d an expenditure which increases the life of the productive tangible asset is added to the asset's account and depreciated over its remaining life 18. Which of the following expenditures would NOT be added to the fixed asset account for manufacturing equipment? a. cost of insuring the equipment during its transit to the factory b. cost of semi-annual routine maintenance of the equipment c. cost of required initial calibration prior to first use of the equipment d. cost of a major overhaul which extends the life of the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts