Question: 13. Below is the output from regressing daily excess return of ABC on daiiy excess return of S&P 500. Sample mean of daily excess return

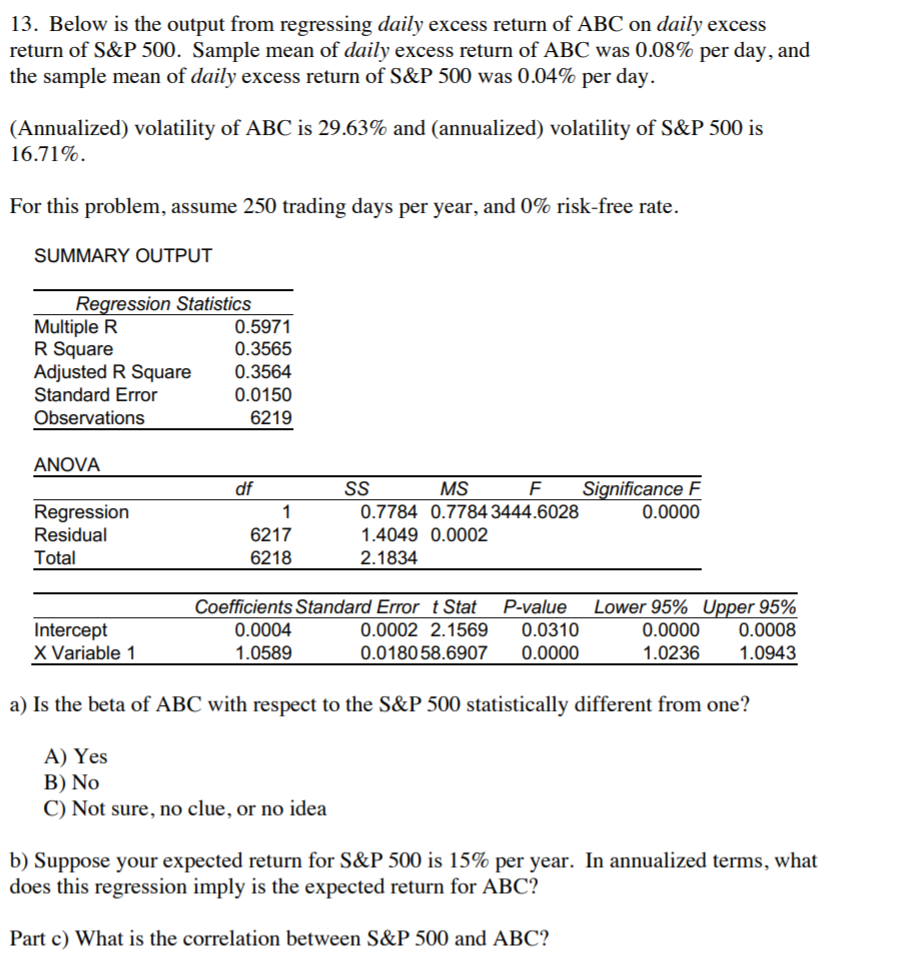

13. Below is the output from regressing daily excess return of ABC on daiiy excess return of S&P 500. Sample mean of daily excess return of ABC was 0.08% per day, and the sample mean of daily excess retum of S&P 500 was 0.04% per day. (Annualized) volatility of ABC is 29.63% and (annualized) volatility of S&P 500 is 16.7 1% . For this problem, assume 250 trading days per year, and 0% risk-free rate. SUMMARY OUTPUT Regression Statistics Multiple R 0.5971 R Square 0.3565 Adjusted R Square 0.3564 Standard Error 0.0150 Observations 6219 ANOVA df 88 MS F ' icanoe F Regression 1 0.7784 0178434446028 0.0000 Residual 6217 1.4049 0.0002 Total 6218 2.1834 Coe'icientsStandard Error tStat P-vaiue Lower 95% ng_er 95% Intercept 0.0004 0.0002 2.1569 0.0310 0.0000 0.0008 X Variable 1 1.0589 0.0180 58.890? 0.0000 1.0236 1.0943 a} Is the beta of ABC with respect to the S&P 500 statistically different from one? A) Yes B) No C) Not sure. no clue, or no idea b) Suppose your expected return for S&P 500 is 15% per year. In annualized terms, what does this regression imply is the expected return for ABC? Part c) What is the correlation between S&P 500 and ABC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts