Question: (13) CRR Binomial Model (a) Use the CRR binomial model with two periods to price a European call option for a stock whose share price

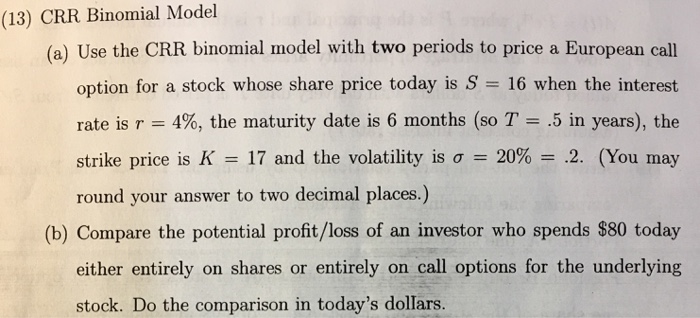

(13) CRR Binomial Model (a) Use the CRR binomial model with two periods to price a European call option for a stock whose share price today is S16 when the interest rate is r = 4%, the maturity date is 6 months (so T = .5 in years), the strike price is K = 17 and the volatility is 20% .2. (You may round your answer to two decimal places.) (b) Compare the potential profit/loss of an investor who spends $80 today either entirely on shares or entirely on call options for the underlying stock. Do the comparison in today's dollars. (13) CRR Binomial Model (a) Use the CRR binomial model with two periods to price a European call option for a stock whose share price today is S16 when the interest rate is r = 4%, the maturity date is 6 months (so T = .5 in years), the strike price is K = 17 and the volatility is 20% .2. (You may round your answer to two decimal places.) (b) Compare the potential profit/loss of an investor who spends $80 today either entirely on shares or entirely on call options for the underlying stock. Do the comparison in today's dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts